9 Top Credit Cards with Travel Insurance 2024

- January 19, 2024

- 20 min read

-

1576 reads

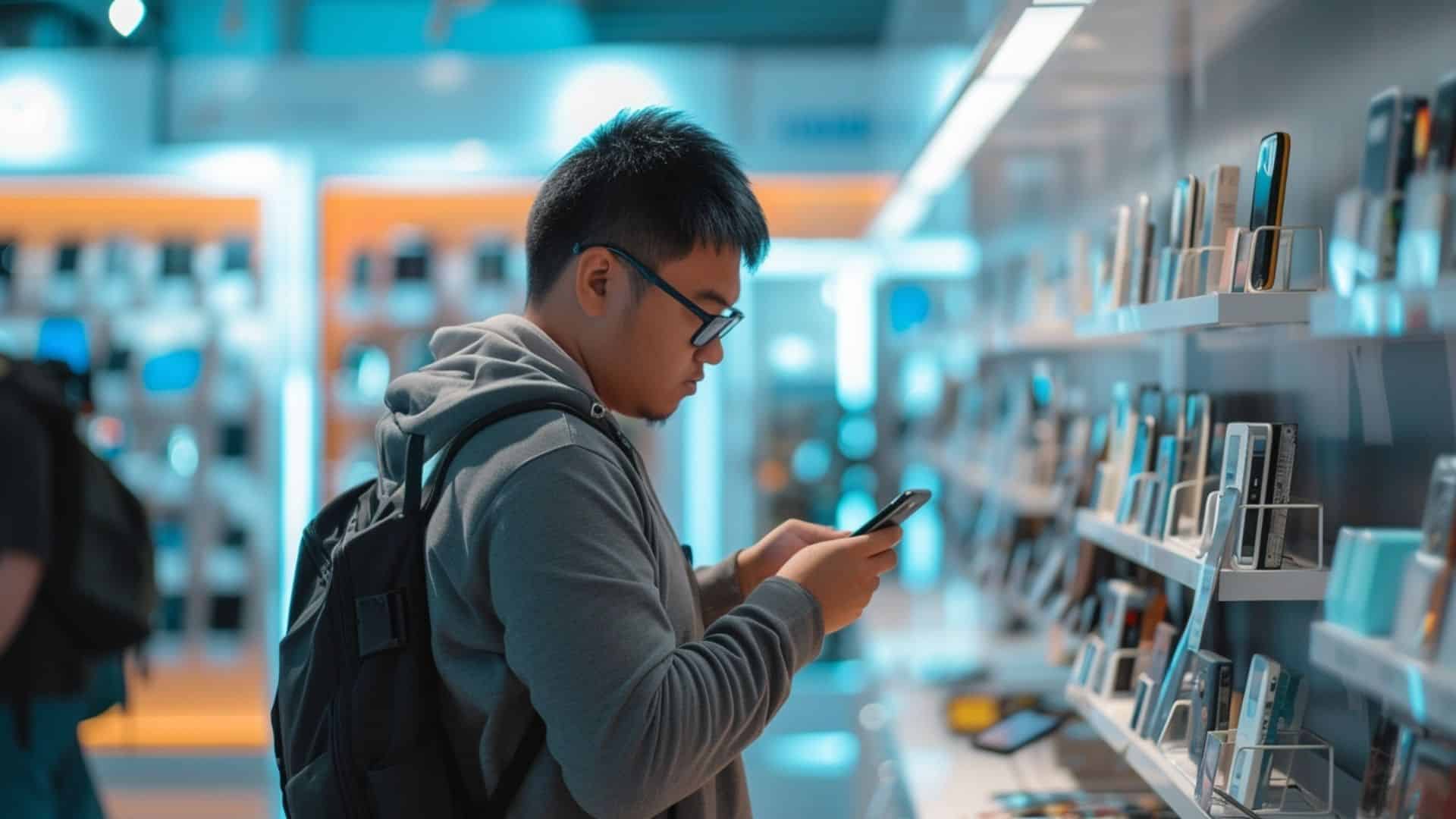

Travel insurance can be a great way to cover unexpected expenses when things go wrong on your trip. Many people wonder if they need travel insurance, but like any other insurance policy, you never know when you’ll need it.

Many credit cards provide travel insurance as a benefit when you use it to pay for rental cars, flights, and other travel expenses. You can add your own travel insurance for additional coverage, but there are some credit cards that come with pretty decent insurance coverage.

Here’s everything you need to know about credit card travel insurance as well as the best credit cards with travel insurance.

What we’ll cover in this post:

Best Credit Cards With Travel Insurance for 2023

Here are our top choices for the best credit cards that offer travel insurance:

| Company | Credit Card | Best For | |

|---|---|---|---|

| Chase Sapphire Reserve® Card | Overall travel insurance | See offer |

| Capital One Venture Rewards X Credit Car… Show more Capital One Venture Rewards X Credit Card Show less | Platinum rewards with low annual fees | See offer |

| PenFed Platinum Rewards Visa Signature® … Show more PenFed Platinum Rewards Visa Signature® Card Show less | Travel accident insurance | See offer |

| Chase Sapphire Preferred® Card | Low annual fees | See offer |

| United Club Infinite Card | United flyers | See offer |

| Marriott Bonvoy Brilliant® American Expr… Show more Marriott Bonvoy Brilliant® American Express® Card Show less | Elite status | See offer |

| Southwest Rapid Rewards® Plus Credit Car… Show more Southwest Rapid Rewards® Plus Credit Card Show less | Southwest flyers | See offer |

| Delta SkyMiles® Gold American Express Ca… Show more Delta SkyMiles® Gold American Express Card Show less | Delta flyers | See offer |

| The Platinum Card® from American Express… Show more The Platinum Card® from American Express Show less | Flexible rewards | See offer |

| Company |

|---|

|

|

|

|

|

|

|

|

|

| Get Started |

|---|

| See offer |

| See offer |

| See offer |

| See offer |

| See offer |

| See offer |

| See offer |

| See offer |

| See offer |

| Company | Overall Rating | Credit Card | Best For | Get Started |

|---|---|---|---|---|

| Chase Sapphire Reserve® Card | Overall travel insurance | See offer | |

| Capital One Venture Rewards X Credit Car… Show more Capital One Venture Rewards X Credit Card Show less | Platinum rewards with low annual fees | See offer | |

| PenFed Platinum Rewards Visa Signature® … Show more PenFed Platinum Rewards Visa Signature® Card Show less | Travel accident insurance | See offer | |

| Chase Sapphire Preferred® Card | Low annual fees | See offer | |

| United Club Infinite Card | United flyers | See offer | |

| Marriott Bonvoy Brilliant® American Expr… Show more Marriott Bonvoy Brilliant® American Express® Card Show less | Elite status | See offer | |

| Southwest Rapid Rewards® Plus Credit Car… Show more Southwest Rapid Rewards® Plus Credit Card Show less | Southwest flyers | See offer | |

| Delta SkyMiles® Gold American Express Ca… Show more Delta SkyMiles® Gold American Express Card Show less | Delta flyers | See offer | |

| The Platinum Card® from American Express… Show more The Platinum Card® from American Express Show less | Flexible rewards | See offer |

Chase Sapphire Reserve® Card

The Chase Sapphire Reserve® card is a premium travel card that offers many benefits to frequent travelers. This card offers up to $1 million in travel accident insurance. It also boasts plenty of travel rewards, including:

- 10x total points on hotels and car rentals when you purchase travel through Chase Ultimate Rewards® immediately after the first $300 is spent on travel purchases annually

- 5x total points on air travel

- 3x points on other travel and dining

- 1 point per $1 spent on all other purchases

Capital One Venture Rewards X Credit Card

The Capital One Venture Rewards X credit card has an annual fee of $95 but comes with a range of benefits and rewards. It’s ideal for cardholders looking for a high rewards rate with flexible redemption options.

The card has lost luggage protection of up to $3,000 and travel accident insurance of up to $250,000. There’s also rental car insurance for up to 15 consecutive days.

The card has an APR of between 20.99% and 28.99% and you need a good credit score of 690 or more to qualify. There are no foreign transaction fees.

Other rewards you can enjoy include a one-time bonus of 75,000 miles when you spend $4000 or more in the first three months and unlimited 2x miles on everyday purchases. You get 5x miles on hotels and rental cars booked with Capital One Travel and you can transfer your miles to 15+ loyalty programs.

PenFed Platinum Rewards Visa Signature® Card

The PenFed Platinum Rewards Visa Signature® offers comprehensive accident insurance that covers dismemberment or death while traveling and includes car rental insurance against collisions or theft.

When it comes to travel rewards, this PenFed rewards card doesn’t disappoint:

- 3 points for every dollar on supermarket purchases

- 5 points for every dollar spent on gas

- 1 point per dollar for all other purchases

One of the best benefits is that you are not limited to the points you can earn.

You can redeem points for merchandise, gift cards, and travel – including car rental, hotel, airline tickets, and vacation deals.

Note: You must have a balance of at least 1,000 points to redeem rewards.

Chase Sapphire Preferred® Card

With the Chase Sapphire Preferred® card, you’ll get trip cancellation or interruption insurance up to $10,000 per person and $20,000 per trip.

This means if your trip is canceled or shortened due to severe weather or sickness, you will be reimbursed for your non-refundable travel expenses, including passenger tours, fares, and hotels.

You can earn some of the best travel rewards on the market. To start, there is an annual $50 credit against hotel purchases made through Chase Travel and this can offset more than half of your $95 annual card fee.

You also get 5x points on Chase Travel purchases and 3x points on eligible online grocery purchases, restaurant dining purchases, and select streaming service purchases. You will get 2x points on all other eligible travel purchases and there is no limit to the number of rewards you can get.

Marriott Bonvoy Brilliant® American Express® Card

The Marriott Bonvoy Brilliant® American Express® credit card offers excellent benefits for high earners. It’s ideal for borrowers with good or excellent credit and the APR ranges between 20.74% to 29.74%.

Some of the benefits include a $300 statement credit per year for eligible restaurant purchases, one free night per year at a participating hotel, and a select Earned Choice Award benefit when you spend $60,000 or more per year.

In terms of travel insurance benefits, you get up to $100 per day for five days if you have a baggage delay, and up to $3,000 per passenger for lost luggage. There’s also a trip delay cover of $500 per ticket for delays of more than 12 hours.

The card comes with a steep annual fee of $650 and a late payment fee of up to $40. There are no foreign transaction fees.

Southwest Rapid Rewards® Plus Credit Card

The Southwest Rapid Rewards® Plus credit card is a rewards card that is especially good for Southwest flyers. There is no cap on rewards and the card comes with plenty of bonus offers.

You’ll earn 60,000 bonus points when you spend $3,000 or more within the first three months of account opening, and 3,000 bonus anniversary points every year. You’ll earn 2x points on Southwest purchases and for purchases on internet, cable, streaming, and phone services.

The card has an annual fee of $69 and an APR of 20.99% – 27.99%.

In terms of travel rewards, you’ll get up to $3,000 in lost baggage cover, and up to $100 per day for delay insurance (for three days). Flight changes are free of charge and so are your first two checked bags.

You’ll also get 25% back on eligible in-flight purchases, making this a good card for those who want to make the most out of travel rewards.

Delta SkyMiles® Gold American Express Card

The Delta SkyMiles® Gold American Express is a great card for frequent Delta flyers and comes with a host of benefits. Rewards don’t expire but you’ll need a good credit score (690 or higher) to apply.

The card has a $0 introductory annual fee for the first year, after which a $99 annual fee applies. The APR ranges between 20.74% and 29.74%.

You get baggage insurance, car rental loss insurance, travel accident insurance, and roadside assistance with this card.

You’ll get 65,000 bonus miles when you spend $2,000 or more in the first six months, and you get your first bag checked free on flights with Delta.

You also earn 15% off when using your travel miles to book Delta flights online or via the app, and you earn 1x mile on all other eligible purchases.

The card has no foreign transaction fees and you can use Send & Split to split card purchases between other PayPal or Venmo users.

The Platinum Card® from American Express

With the Platinum Card® from American Express has plenty of perks and a lot o travel benefits for frequent travelers. The card gives you automatic elite status and you’ll need a credit score of at least 690 to apply.

With this Platinum card, you get trip cancellation insurance of up to $10,000 per trip, along with up to $3,000 in lost baggage insurance. The card also has rental car insurance up to $75,000 and travel accident insurance up to $500,000.

In terms of rewards, you’ll earn 80,000 reward points when you spend R6,000 or more in the first six months and 5x membership awards for flights booked directly with airlines or American Express Travel. There’s also a $240 digital entertainment credit, and a $200 hotel credit every year.

The Platinum Card® from American Express comes with a hefty annual fee of $695 and APRs between 20.99% and 28.99%.

United Club Infinite Card

The United Club Infinite Card comes with 80,000 bonus miles when you spend $5,000 or more in the first three months, and you earn a further 4x miles on all United purchases like tickets, inflight food, Wi-Fi, and beverages.

The card has an annual fee of $525, and a regular APR of 21.49% – 28.49%.

It comes with trip cancellation insurance, trip delay insurance, and baggage delay insurance of up to R100 a day. It also has rental car insurance.

The card is perfect for frequent Delta flyers as you get access to Delta Sky Club airport lounges and your first checked bag free.

What Does Travel Insurance Cover?

Here’s what credit card travel insurance typically covers:

- Lost or damaged baggage

- Baggage delay

- Trip delay

- Trip cancellation

- Travel accident insurance

- Rental car theft or damage

- Emergency evacuation

- Emergency medical assistance

💡 Compare travel insurance plans here

Benefits of Travel Insurance

Financial Protection

One of the main benefits of travel insurance on credit cards is financial protection. If you need to cancel your trip due to unforeseen circumstances, like illness, severe weather conditions, or a job loss, trip cancellation and interruption insurance can reimburse you for your non-refundable expenses.

If your luggage is lost, stolen, delayed, or damaged, baggage delay or loss insurance can provide compensation.

A car rental collision damage waiver can cover costs due to damage or theft of a rental vehicle.

Supplemental Coverage for Medical

While abroad, if you fall ill or get injured, travel insurance on your credit card can provide supplemental coverage for medical emergencies.

This can include hospital stays, medical services, and sometimes even dental emergencies, depending on your credit card’s policy.

Note that this coverage often works as secondary insurance, which means it kicks in after any other primary insurance you may have.

Evacuation Assistance

In case of severe injury or illness, or in the event of a natural disaster, evacuation assistance can help cover the costs of medically necessary evacuation. This can be to a nearby hospital or even repatriation back to your home country if you’re not able to continue your travels.

Emergency assistance services can also help with arranging the evacuation, ensuring you get the help you need even in stressful situations.

Peace of Mind

Perhaps one of the less tangible but highly valuable benefits of travel insurance on credit cards is the peace of mind it offers.

Knowing that you’re protected against a range of potential issues can make traveling a less stressful experience.

Whether it’s dealing with lost luggage, a medical emergency, or an unexpected need to cancel your trip, having travel insurance means you won’t need to worry as much about what could go wrong.

Plus, many credit cards offer 24/7 travel assistance services, so help is just a phone call away if you need it.

icy covers and when you can claim. Make sure to read the fine print and look for deadline dates or policy limitations.

How To Choose the Right Travel Insurance Card

What Benefits Are Important To You?

The best travel insurance card for you is the one that aligns most closely with your personal needs and travel habits.

If you often travel internationally, you might prioritize benefits like overseas medical coverage, or emergency evacuation and repatriation.

If you’re a leisure traveler, you might be more interested in trip cancellation and interruption protection, or lost luggage insurance.

For frequent fliers, the inclusion of delay protection that covers meals and accommodation if your flight is significantly delayed may be key.

Also, consider specific services that may be important. Some cards offer 24/7 global assistance hotlines, which can be invaluable if you find yourself in an emergency situation in a foreign country.

How Much Coverage Do You Need?

A good rule of thumb is to have enough coverage to protect the full cost of your trip. This includes factors like non-refundable costs of your trip, including flights and accommodation, and potential medical costs in your destination country.

If you’re traveling to a country where medical care is expensive, such as the United States, you might want more robust medical coverage.

If your trip involves higher risk activities like winter sports or scuba diving, you might need a card that offers additional coverage for these activities.

When Will the Coverage Apply?

It’s crucial to understand when your insurance coverage will kick in. Some cards provide coverage from the moment you book your trip, while others only cover you from the start of your journey.

Be sure to check for specific events that are covered. For instance, trip cancellation coverage might only apply if the cancellation is due to unforeseen circumstances like illness or natural disasters.

Medical coverage might not apply if you’re injured while participating in certain high-risk activities.

Cover for Family Members

Some cards offer coverage for your spouse and dependent children at no additional cost, while others might require an additional fee.

Check the age limits for dependent children, as this can vary between cards. If you’re traveling with older relatives, you might need to purchase additional coverage, as some cards limit coverage for travelers above a certain age.

How To Claim from the Insurance Company

Although each insurer is different, there are general steps to follow when claiming from the insurance company:

Contact Your Insurer

You will need to contact your insurance provider as soon as possible after the incident. Keep in mind, many insurance providers have specific time frames within which you must report a claim. Be prepared to provide details of the incident, including where and when it occurred, as well as the costs incurred.Have Documentation Ready

Documentation is key to a successful claim. This means keeping all receipts, medical records, police reports, or any other evidence that supports your claim. For example, if you’ve received medical treatment, ask for a detailed report from the medical facility.Fill Out the Claim Forms

After reporting the claim, you’ll typically need to fill out a claim form provided by your insurer. This form will ask for detailed information about the incident and your expenses. Be sure to fill this out as thoroughly and accurately as possible.Wait for Review

Once your claim is filed, the insurance company will review it. This process can take several weeks, depending on the complexity of the claim. You might be asked to provide additional information or documentation during this time.Get Reimbursed

inally, once the review is complete, your insurer will inform you of their decision. If your claim is approved, you’ll be reimbursed for your expenses, up to the coverage limits of your policy. If your claim is denied, the insurer should provide a reason for their decision. If you believe the denial was unjust, most companies have an appeals process you can follow.Credit Card Travel Insurance – FAQs

Do credit cards help with travel insurance?

Do credit cards automatically have travel insurance?

Does visa cover trip cancellation?

Does visa have travel accident insurance?

What is the best card for travel insurance?

What is travel protection on a credit card?

Do all Visa cards have travel insurance?

What should I ask about when applying?

Is it enough to have travel insurance with a credit card?

Sources

- Business Insideraccessed on June 29, 2023