The Best Credit Cards for April 2024

- 24.90% regular purchase APR

- Monthly payments reported to three credit bureaus

- Starting credit limit of $300

- Pre-qualify with no impact on your credit score

- No annual fee

- Redeem points straight into crypto

- Get 2% cash back on all purchases

- 17.49% to 29.49% variable APR

- See if you’re Pre-Qualified with no impact to your credit score

- 29.99% variable APR

- $75 annual fee

- Free access to your Vantage 3.0 score from Experian* (When you sign up for e-statements)

- Earn 1% cash back rewards on payments made to your Total Credit Card

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.

- $75 annual fee for the first year

- Horizon Gold Card with $500 unsecured credit limit

- No credit check needed, Bad credit score accepted

- 0% APR on credit

- One time activation fee: $5. Monthly membership fee: $24.95

Important

As seen in

How to Find the Best Unsecured Credit Cards

Save money by comparing with us first.

compare unsecured cards, rewards cards, cards for bad credit, and more.

Compare rates from card issuers side-by-side.

Choose the credit card offer that suits your needs

Click to apply online and get pre-qualified in minutes.

What Is an Unsecured Credit Card?

Unsecured credit cards are the most common type of credit card. You don’t need a security deposit for approval.

The issuer of an unsecured credit card does not have a security deposit that they can collect if you do not pay your credit card balance.

Instead, the creditor has the option of pursuing additional collection measures.

This can include sending your account to a debt collector, reporting your non-payment to credit bureaus, and even suing you in court. They may also request to garnish your wages.

Because they are unsecured and have no collateral, unsecured credit cards are different from secured loans, such as mortgage loans, auto loans, and secured credit cards.

They are not directly connected to any property, so the issuer has no right to take your property away if you default on payments.

Our Top Unsecured Cards

Milestone MasterCard®: Best for Easy Online Pre-Qualification

The Milestone MasterCard® allows you to enjoy the benefits of a credit card without needing a security deposit.

If you don’t have a good credit history or prior bankruptcy, this is a good option.

It comes with fraud protection and zero liability.

Pros:

- Easily pre-qualify online

- Credit limit starts at $300

- Reports to all three credit bureaus

- Fraud protection

- No security deposit required

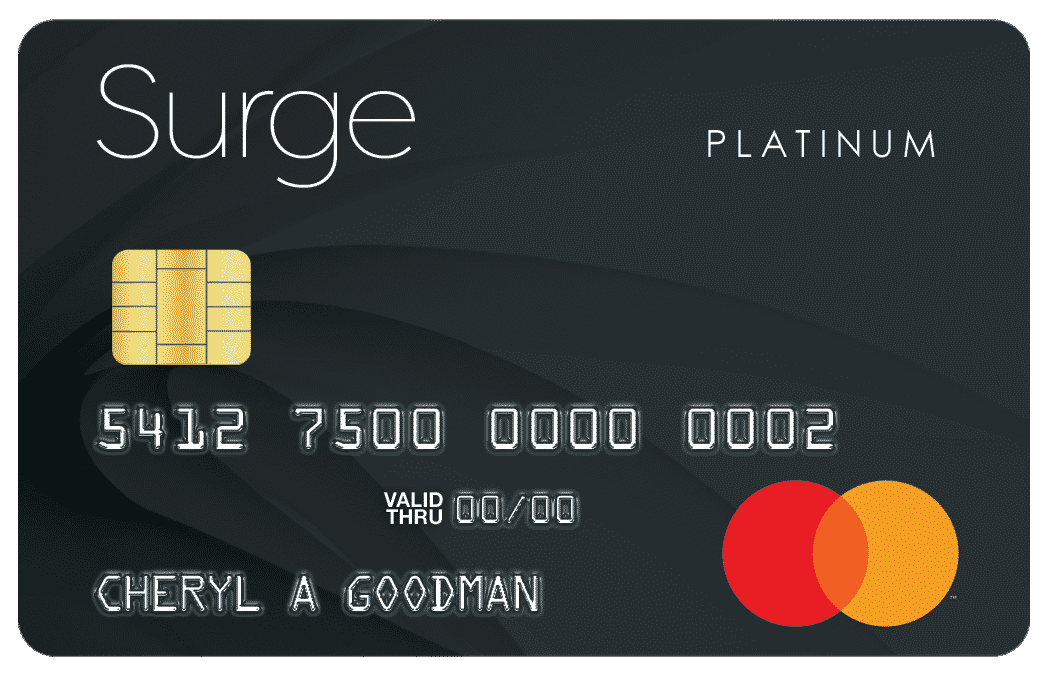

Surge MasterCard®: Best for Higher Initial Limits

The Surge Mastercard® Credit Card is one of the more popular unsecured credit cards that comes with an initial credit limit between $300 – $1,000.

Enjoy peace of mind with the Surge MasterCard as it offers $0 fraud liability so you won’t be held responsible for unauthorized charges on your card.

You’ll get free monthly credit scores and monthly reporting to all three major credit bureaus – TransUnion, Equifax, and Experian.

Credit limits may be eligible for an increase after six months, making this a great option to improve your credit score.

Pros:

- Initial credit limits start at $300

- Credit limit doubles after 6 monthly on-time payments

- Mastercard Zero Liability Protection

- Monthly reporting to all three credit bureaus

- Free monthly credit score

Total Visa® Unsecured Credit Card: Best for Cash Back

The Total Visa® Unsecured Credit Card offers an initial credit limit of $300 with manageable monthly payments and a fast application process.

You can select your favorite card design and use your card at merchants nationwide across the USA and online.

The Total Visa® Unsecured Credit Card has an annual fee of $75 for the first year and $48 thereafter.

The APR is 34.99% and there are no cash advance fees for the first year.

Pros:

- Initial credit limit of $300

- Get 1% cash back rewards

- Free credit monitoring

- Instant online approval

How Unsecured Credit Cards Work

Unsecured credit cards are available from the majority of banks, credit unions, and other financial service providers.

To obtain one, you must fill out an application with your personal information and agree to a credit check.

After you’re authorized for an unsecured credit account, you’ll receive a card that you may use to make purchases in stores, online, and over the phone.

Tip: To get a reasonable interest rate on your credit card you should have a good credit score (typically 670+). You may still qualify for a card with a low credit score but this may come with higher interest rates.

Unsecured credit cards fall under the category of revolving credit. This means you’re allowed to spend up to a particular amount on the account, and you have the option of paying off the debt in full at the end of a monthly billing cycle or revolving it to the following month.

If you pay your debt in full there is no interest payable.

When you choose to let the balance revolve, you will make interest payments and adhere to the minimum monthly payment.

Note: When people refer to a “credit card,” they usually mean an unsecured credit card. This is because most available credit cards are unsecured.

Why Compare Credit Cards with Financer.com

Applying for a Credit Card

Banks are unlikely to give you an unsecured credit card if you have a poor credit score or failed to make timely payments in the past.

The issuer may also deny you if you have too many credit cards, too many credit inquiries or insufficient income.

Before applying for unsecured credit cards, you should pull your credit report and make sure there are no flaws that may cause the issuer to reject you.

You can request a free credit report from the three major reporting bureaus once every 12 months at AnnualCreditReport.com.

Tips for Choosing the Best Unsecured Credit Cards

Features and Benefits

You need to decide what features you are looking for, like the lowest rates, the highest credit limits, or the easiest online application process.

Fees

Some unsecured credit cards may have application fees and high interest rates because there is no collateral required. Beware of balance transfer and foreign transaction fees.

Also consider the annual fee as some providers may offer a low initial fee that will increase after the first year.

Using Your Card

When you want to rebuild your credit you need to try and avoid high interest rates and one way of doing this is by paying the full balance every month.

If you make regular payments on time you may qualify for a higher credit limit. Some credit card providers automatically increase your credit limit after six months of on-time payments.

What Customers Say About Us

4.60 based on 324 reviews

from Reviews.io

Compare Credit Cards with Financer.com

Financer.com helps you compare the best unsecured credit cards and get the lowest rates from leading U.S. lenders.

We look for lenders that offer full transparency and have a long track record of successful lending and satisfied customers. We are always improving our comparisons, but are confident in what we can bring to market, and we know you will be as well.

Use our free credit card comparison to find the right credit card for your needs.

Unsecured Credit Cards - FAQs

What is an unsecured credit card?

What is an unsecured credit card for fair credit?

What is the easiest unsecured card to get?

What credit score do you need for an unsecured card?

What is the unsecured credit limit?

This is the credit limit you get with your unsecured credit card. Unsecured means you didn't have to put up any collateral.

Can you get a unsecured credit card with a 540 credit score?

Yes, but you may have to pay higher interest rates.

Read More About Credit Cards

What Credit Cards Use TransUnion?

When you're looking into "which credit cards use TransUnion," it's likely that you're attempting to tailor your credit card applications based on your TransUnion credit

January 28, 2024 16 min read

2023 Consumer & Credit Card Debt Statistics – Interactive Report

March 25, 2024 19 min read

How To Build Credit with a Credit Card: The Ultimate Guide

Building credit from scratch or rebuilding bad credit can seem like a daunting task. However, if you develop good credit habits, you will find the ...

December 26, 2023 14 min read

How To Stop Automatic Payments to Your Credit Card and Save Big

December 26, 2023 6 min read

What Is a Credit Utilization Rate?

Credit utilization is an important concept that is often overlooked when it comes to credit health. It is a measure of how much new credit you ...

January 19, 2024 4 min read