Loans Like Speedy Cash: 6 Alternatives for Quick Cash

April 25, 2024 22 min read

$50 Loan Instant App

April 25, 2024 27 min read

8 Apps Like Earnin For Quick Cash

April 25, 2024 21 min read

Popular posts

Cheapest States to Live In 2024 – Top 5 States Where Your Dollar Will Go Further

April 24, 2024 18 min read

Best Finance Podcasts – Top 20 Financial Podcasts for 2024

January 19, 2024 33 min read

Diversify Wisely: Explore Alternative Investments with EXANTE

January 17, 2024 9 min read

HSA Hack: The Best Kept Secret in Financial Planning

January 19, 2024 6 min read

8 Best Cash Advance Apps Like Dave 2024

February 11, 2024 17 min read

Seeking Alpha Premium Review: Buy and Hold

January 22, 2024 12 min read

A Deep Dive into SoFi’s High Yield Savings Account

January 17, 2024 9 min read

What Credit Cards Use TransUnion?

January 28, 2024 16 min read

Which Credit Cards Use Experian?

January 28, 2024 11 min read

15 Legal Ways to Pay Less in Taxes and Keep More of Your Money

March 26, 2024 29 min read

Explore our topics

2023 Consumer & Credit Card Debt Statistics – Interactive Report

March 25, 2024 19 min read

12 Top Tax Deductions: Food, Travel, Spending, and More

January 19, 2024 24 min read

Which Credit Cards Use Equifax?

April 24, 2024 15 min read

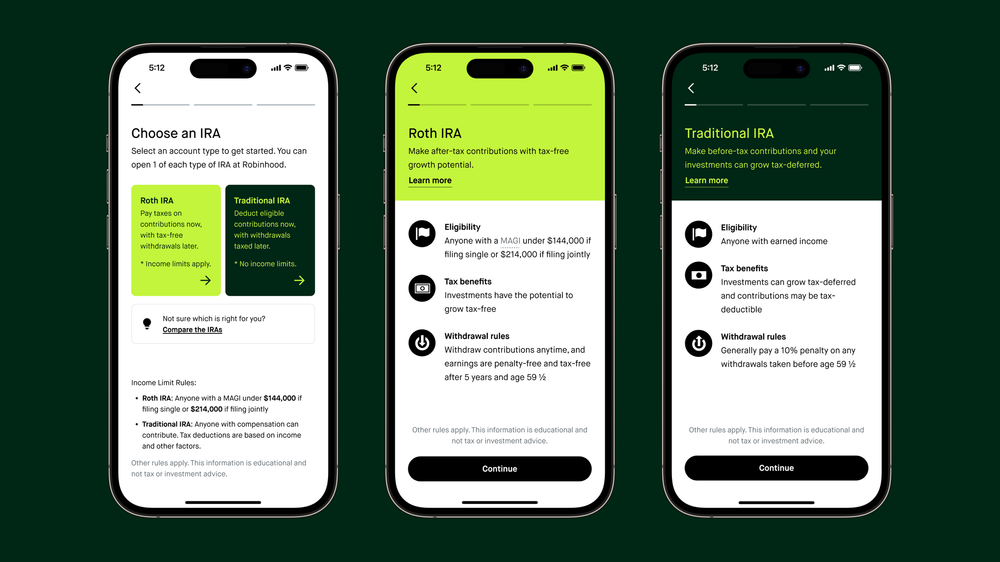

The Robinhood IRA: Everything You Need To Know

January 19, 2024 7 min read

What Is the Best Stablecoin? 8 Top Stablecoins to Buy in 2024

January 17, 2024 13 min read

You Should Invest In Dogecoin and Here are 5 Reasons Why

January 19, 2024 7 min read

What Can You Buy with Bitcoin? A Complete Guide to Buying Things with Cryptocurrency

January 19, 2024 18 min read

5 Ways to Beat Inflation and Prepare for a Possible Recession in 2023

January 19, 2024 10 min read

Is a 4th Stimulus Check Happening in 2024?

January 19, 2024 17 min read