The Top 100 Personal Finance Blogs 2024

- January 19, 2024

- 111 min read

-

14568 reads

With thousands of finance blogs out there, who knows where to start? Financer.com has put together the ultimate list of the top 100 personal finance blogs in 2023.

Wherever you are on your journey to financial freedom, this list of the best personal finance blogs will inspire, encourage and equip you along your way.

With every finance blog offering unique concepts, ideas and solutions it’s hard to list them 1 to 100 so we have listed them in alphabetical order.

From FIRE to trading, budgeting to paying off debt, each personal finance blog has a wealth of experience and valuable content. Enjoy clicking through to find one that inspires you to continue building long-term wealth.

This list is ranked alphabetically. All featured blogs are the best the internet has to offer. Enjoy!

Top 100 Personal Finance Blogs 2023

- 1.1500 Days To Freedom

- 2.20 Something Finance

- 3.A Purple Life

- 4.A Wealth of Common Sense

- 5.Afford Anything

- 6.Arrest Your Debt

- 7.Ask The Money Coach

- 8.Beyond Pennies

- 9.Bible Money Matters

- 10.Broke Millennial

- 11.Budgets Are Sexy

- 12.Cash Money Life

- 13.Clever Dude

- 14.Clever Girl Finance

- 15.Couples Money

- 16.Cut The Crap Investing

- 17.Dave Ramsey

- 18.Deal Seeking Mom

- 19.Dear Debt

- 20.Debt Discipline

- 21.Debt Roundup

- 22.Dough Roller

- 23.Early Retirement Extreme

- 24.Ellevest

- 25.Eric Nisall

- 26.ESI Money

- 27.Everything Finance

- 28.Farnoosh

- 29.Femme Frugality

- 30.Finance Analyst Starter Kit

- 31.Financial Samurai

- 32.Four Pillar Freedom

- 33.Frugal Beautiful Life

- 34.Frugalwoods

- 35.Get Rich Slowly

- 36.Girls Just Wanna Have Funds

- 37.Good Financial Cents

- 38.Her First 100k

- 39.His and Hers FI

- 40.I Will Teach You To Be Rich

- 41.Jean Chatzky

- 42.JL Collins

- 43.Just Start Investing

- 44.Learn Hustle Grow

- 45.Learn to Trade the Market

- 46.Living Low Key

- 47.The Mad Fientist

- 48.Making Sense of Cents

- 49.Marriage Kids and Money

- 50.Mastering The Side Jam

- 51.Millennial Money Man

- 52.Millennial Money

- 53.Millennial Revolution

- 54.Modern Frugality

- 55.Modest Money

- 56.Money After Graduation

- 57.Money Geek

- 58.Money Peach

- 59.Money Saving Mom

- 60.Money Smart Life

- 61.MoneyNing

- 62.Moolanomy

- 63.Mr. Money Mustache

- 64.My Fab Finance

- 65.My Financial Shape

- 66.My Money Blog

- 67.Oblivious Investor

- 68.Of Dollars And Data

- 69.Our Next Life

- 70.Penny Pinchin Mom

- 71.Retire By 40

- 72.Rich and Regular

- 73.Saving Advice

- 74.Seed Time

- 75.Smart Money Mamas

- 76.Something Finance

- 77.Squawkfox

- 78.Stefanie O’Connell

- 79.The Financial Diet

- 80.The FIoneers

- 81.The Military Wallet

- 82.The Minimalists

- 83.The Money Habit

- 84.The Penny Hoarder

- 85.The Savvy Couple

- 86.The Simple Dollar

- 87.The White Coat Investor

- 88.Think Save Retire

- 89.Three Thrifty Guys

- 90.Wall Street Bets

- 91.Wallet Hacks

- 92.Wealthy Nickel

- 93.Well Kept Wallet

- 94.Wife.org

- 95.Women Who Money

- 96.Young Money Blog

- 97.Your Money Geek

1500 Days To Freedom

1500 Days to Freedom gives a detailed breakdown of how the author found his financial independence. This blog gets into the nitty-gritty of rejecting consumerism and running towards a secure future.

Facebook: @1500days

Twitter: @retirein1500

Instagram:@1500days

“So, do you want to work until you’re 80 or be able to retire to a beach in Costa Rica when you’re 45? I enjoy my work, so I’m not sure. What I do know though is that I want the freedom to choose.”

– Featured Quote from 1500 Days To Freedom

🏅 Favorite article

The awakening, is where it all began. Carl describes what inspired him to begin his journey towards financial independence.20 Something Finance

20 Something Finance helps young professionals become financially responsible and live a more environmentally friendly and self-aware lifestyle.

Facebook: @20somethingfinance

Twitter: @GE_Miller

“Stop chasing happiness through consumption. Realize and acknowledge it for being the mirage that it is.”

– Featured quote from 20 Something Finance

🏅 Favorite article

Do you think consuming more will always make you happier? The Consumption & Happiness Paradox will help you break this myth and give you practical tips on how to live a happier life.A Purple Life

A Purple Life is a fresh and honest blog that journals the author’s ride to retirement at 30 years old. You will find a wide range of topics on this blog that spans far beyond personal finance.

Facebook: @APurpleLife

Twitter: @APurpleLifeBlog

Instagram: @APurpleLife

“My main objective in retirement is to spend more time with my loved ones and I can’t do that if they’re not around. Tomorrow is never guaranteed. Everything is a risk and this is the level of risk I am comfortable with.”

– Featured quote from A Purple Life

🏅 Favorite article

Preparing for an early retirement involves not just intense financial planning but also lots of mental willpower. In The Stages Of Impatience On The Path To Financial Freedom, A Purple Life describes her 5-year mental struggle as she wrestles with her own mind while making such a big life decision.A Wealth of Common Sense

A Wealth of Common Sense is a blog focused on wealth management, financial markets, and investing. It takes complex financial concepts and breaks them into everyday language that anyone can understand. Specifically focussing on simplifying investment solutions and the psychology behind finance and investment.

Twitter: @awealthofcs

“The stock market doesn’t care about feelings. It just keeps right on moving along, discounting the future. And in this crisis, during the biggest quarterly drop in economic activity in our country’s history, the stock market looked across the valley.“

– Featured quote from A Wealth of Common Sense

🏅 Favorite article

In The Best Time to Give Back, Ben from A Wealth of Common Sense discusses the internal tug of war we can sometimes have when choosing whether to make charitable donations public or anonymous. He goes into the major part giving plays in our personal finances and how it can affect our perceptions and happiness.Afford Anything

In Afford Anything, Paula Pant helps you define your financial values and build wealth through smart investments so that you can create a financially independent life. Through creating a passive income Paula has broken the shackles of paycheck-dependence and now inspires others to do the same.

Facebook: @AffordAnything

Twitter: @AffordAnything

Instagram: @paulapant

“Let me be clear: I’m not a beach bum who wants to drink margaritas all day. I wanted the freedom to work on Purpose-Driven projects, instead of relying on a paycheck for groceries and gas.“

– Featured quote from Afford Anything

🏅 Favorite article

In 17 Lessons to Improve Your Money & Life, Paula shares everything she has learned about money and life in the last decade through much research, reading, interviews and trial and error. She talks about reframing gratification, picking niche investment strategies and the power of focusing on habits over will power.Arrest Your Debt

Arrest Your Debt is an honest and inspiring personal finance blog helping readers get rid of debt for good with practical resources to help you stay on track. From budget templates to printables and finance calculators, Arrest Your Debt is the place to go when you need to get on top of your finances.

Facebook: @Arrestyourdebt

Twitter: @Arrestyourdebt

Instagram: @arrestyourdebt

“If you don’t have a budget, you are living dangerously. You have either fallen off the proverbial financial ship or are taking on water and sinking slowly without even realizing it.“

– Featured quote from Arrest Your Debt

🏅 Favorite article

Struggling with your credit score? In 5 Tips You Can Do To Avoid A Bad Credit Score, Ryan from Arrest Your Debt shares a step by step process for getting into the green and improving your overall financial health.Ask The Money Coach

Ask The Money Coach is the product of Lynnette Khalfani-Cox’s wealth of expertise in personal finance. After writing 15 money-management books, Lynette decided to create Ask The Money Coach where she shares her valuable insights on everything from taxes to investing, entrepreneurship to family finances. This blog definitely deserves to be among the top finance blogs.

Facebook: @lynnettekhalfanicox

Twitter: @themoneycoach

Instagram: @lynnettekhalfanicox

LinkedIn: @askthemoneycoach.com

“Millionaires are quietly setting up a life of wealth instead of being distracted by things that make them look wealthy in the eyes of friends and associates.“

– Featured quote from Ask The Money Coach

🏅 Favorite article

In Saving and Investing – One Won’t Make You Rich, Lynette discusses the two-pronged approach of investing and saving side by side. Explaining how nobody becomes rich just from saving alone, but the practice is a crucial part of your financial journey all the same.Beyond Pennies

Beyond Pennies helps people save smart and invest well. The blog focuses on saving, investing, and working towards financial freedom. You can enjoy free worksheets and exclusive templates as well as a plethora of knowledge on becoming financially healthy.

Facebook: @BeyondPennies

Twitter: @BeyondPennies

Instagram: @beyondpennies

“For each tenet of stoicism, there is a reasonable application to personal finance. It’s actually kind of brilliant how it all fits together and creates the perfect financial mindset.“

– Featured quote from Beyond Pennies

🏅 Favorite article

Shelley shares the power of compound interest in The Most Powerful Force In The Universe Is Compound Interest. Explaining how it works, why it makes such a big impact on your long-term wealth and her top financial tips for using it to boost your portfolio.Bible Money Matters

Bible Money Matters was created by Peter Anderson in 2008 as a way to discuss his two greatest passions and offers personal finance from a religious perspective. If religion is a big part of your life then this blog will definitely speak to you.

Facebook: @biblemoneymatters

Twitter: @MoneyMatters

“When I was younger and single, I didn’t worry about money all that much. Now that I’m responsible for the only income for my family of four (and that income is unpredictable), money is on my mind all the time. I’ve found that having a sufficient emergency fund makes a huge difference for peace of mind.“

– Featured quote from Bible Money Matters

🏅 Favorite article

In Personal Financial Improvements With The Fruit Of The Spirit, Tim from Bible Money Matters describes nine key character traits including Love, joy, peace, patience, kindness, goodness, faithfulness, gentleness, and self-control and how these traits all affect our relationship with money.Broke Millennial

Broke Millennial is all about getting your financial life together and Erin Lowry, the original ‘broke millennial’ is passionate about helping millennials specifically to understand and improve their financial health.

Facebook: @BrokeMillennial

Twitter: @BrokeMillennial

Instagram: @brokemillenialblog

“It’s time to get your financial life together. It doesn’t need to be terrifying, it just needs to get done.“

– Featured quote from Broke Millennial

🏅 Favorite article

In How to Navigate Awkward Money Situations, Erin gives her tried and tested advice for the uncomfortable money situations many millennials worry about. If you’re more of a video person then you’ll love the quick and easy to watch Youtube video that accompanies this article.Budgets Are Sexy

J. Money and now 5am Joel manage the award-winning blog Budgets Are Sexy. They discuss everything from budgeting to building savings, early retirement, and learning to hustle.

Facebook: @budgetsaresexy

“You can stop working a helluva lot earlier if you only need $1,000 a month to live vs, say, needing $10,000. You may not be living as sexy a life as you’d like, but mathematically that’s what you’re looking at.“

– Featured quote from Budgets are Sexy

🏅 Favorite article

The “Setback” Fund is a light-hearted read with a very smart idea behind it. Covering the many cases that we face a financial setback from losing a job to dropping your phone or getting a speeding ticket, J. Money explains how these situations can only set you back if you’re not financially prepared for them.Cait Flanders

Cait Flanders blog turned two books calls forth your inner mindful consumer hidden somewhere in your wallet between your Costco card, visa, AmEx, and coupons. A fantastic read for those wanting to be more intentional with their money and life.

Instagram: @caitflanders

“In order to change paths and live a more intentional life, you might need to embrace an adventurous mindset. We can all learn how to do that.“

– Featured quote from Cait Flanders

🏅 Favorite article

In Interview with the First Friend Who Read My New Book, Cait dives into the experience of writing her latest book (the new format of her blog), ‘Adventures in Opting Out’. If you miss Cait’s old posts and are looking for something to fill the void, this is your chance.Cash Money Life

The same author as The Military Wallet, Cash Money Life is a blog journaling Ryan Guinea’s road to money management, entrepreneurship, and career. Loaded with great content, Cash Money Life is a must-read.

Facebook: @CashMoneyLifeBlog

Twitter: @CashMoneyLife

“I’ve said it before and I will say it again – there is no one-size-fits-all approach to money management.“

– Featured quote from Cash Money Life

🏅 Favorite article

If financial independence is your goal but you’re currently feeling like this is out of reach then Career Skills that Can Create Financial Independence might be the perfect place to start. Learn what it really means, how you can achieve it and what skills and careers are going to put you in the best possible place to reach financial independence for yourself.Clever Dude

Clever Dude blog offers a great wealth of knowledge on everything family, marriage, finance, and life. If you need to get in control of your family’s budget then you’ll find plenty of great financial tips here.

Facebook: @Clever-Dude

Twitter: @cleverdude

“One of the reasons people get into debt is because they either lack discipline or they lack planning for what life throws at us.“

– Featured quote from Clever Dude

🏅 Favorite article

Making the Case for Modernizing Your Payment Solutions Today will tell you everything you need to know about updating your payment solutions. Discussing the pros of this new cashless and cloud-driven payment culture and the advantages of artificial intelligence.Clever Girl Finance

Clever Girl Finance is a personal finance blog passionate about helping women grow their financial literacy and confidence. It’s a valuable resource for women who value their financial well-being.

Facebook: @clevergirlfinance

Twitter: @CleverGirlCGF

Instagram: @clevergirlfinance

“Although a frugal lifestyle can seem like a sacrifice in quality, it doesn’t have to be. Instead, you can choose to be frugal in ways that will add more value to your life.“

– Featured quote from Clever Girl Finance

🏅 Favorite article

Rich VS Wealthy: Key Differences Between The Two goes into the two starkly different worlds of the rich and the wealthy.Couples Money

Sharing finances in a relationship can be challenging. Couples Money helps partners have tough finance conversations and provides actionable solutions to work towards their joint goals.

Facebook: @couplemoney

Twitter: @CoupleMoney

Instagram: @couplemoney

“Merging finances is more than combining bank accounts. It’s working together with the good, bad, and awkward, including dealing with debt.“

– Featured quote from Couple Money

🏅 Favorite article

How to Build Wealth Together shares how couples can play to their financial strengths, work towards shared goals and speak frankly with one another about such an important part of life, finance.Cut The Crap Investing

Dale Roberts is an investment expert. He began his blog to help Canadians invest their hard-earned money. Cut the Crap Investing covers detailed wealth management topics from financial planning to finance behaviors.

Facebook: @cuthecrapinvestingblog

Twitter: @67Dodge

“One of the reasons people get into debt is because they either lack discipline or they lack planning for what life throws at us.“

– Featured quote from Cut The Crap Investing

🏅 Favorite article

The COVID Effect: Millenials Understand the True Cost of Barista-Brewed Coffee. Discusses the effect COVID-19 has had on millennial spending, investing and debt.Dave Ramsey

Dave Ramsey has helped millions of people find financial freedom through his expert methods and his personal finance blog is described by many as the holy grail.

Facebook: @daveramsey

Twitter: @DaveRamsey

Instagram: @daveramsey

“It is possible that the greatest character trait of people who win is simply perseverance.

– Featured quote from Dave Ramsey

🏅 Favorite article

In How to Pay Off Collections, Dave shares how you can get on top of your debt, remove the fear factor and begin making payments that will relieve both your financial and mental health.Deal Seeking Mom

Deal Seeking Mom has been helping moms and others save money so they can spend it on the things that matter most to them since 2008.

Facebook: @DealSeekingMom

Twitter: @TaraKuczykowski

Instagram: @unsophisticook

“I’ve learned how to save on the things I NEED, so I can spend on the things I WANT.”

– Featured quote from Clever Dude

🏅 Favorite article

Rather than a favorite article, as this really depends on the kinds of deals you’re looking for, we’ve chosen a favorite section for this helpful blog. Top Amazon Deals is, you guessed it, full to the brim of deals to be found on Amazon which will save you money and give you plenty of inspiration at the same time.Dear Debt

Melanie Lockert created Dear Debt as a way to chronicle her journey of breaking up with over $80,000 dollars of debt. She now helps others to do the same and is especially passionate about debt-related suicide prevention and empowering women to take control of their finances.

Facebook: @melanie.ann.31

Twitter: @deardebtblog

“You are not a loan. You are not alone.”

– Featured quote from Dear Debt

🏅 Favorite article

Our favourite article on Dear Debt is actually more of a series, a collection of raw and honest letters people have written about their relationships with debt, Dear Debt Letters.Debt Discipline

Debt Discipline can help readers get out of debt and control their spending. After getting his family out of $109,000 worth of debt, Brian now helps others to do the same and improve their quality of life without living beyond their means.

Twitter: @FinLitBrian

““Americans are drowning in debt because they start borrowing without any discipline. As a result, debt doesn’t just derail their spending pattern for the present and future but also robs them of their peace of mind.”

– Featured quote from Debt Discipline

🏅 Favorite article

In 13 Easy Ways to Invest with Little Money Debt Discipline shares how investing is not just a wealthy person game anymore. From work-place retirement accounts to stocks and investment funds, there’s always something out there that will fit your budget and circumstances.Debt Roundup

Grayson Bell shares resources and solutions on how to get out of debt and increase your income through Debt Roundup. Grayson also warns that he is not afraid to discuss more unspoken and controversial topics.

Facebook: @DebtRoundUp

Twitter: @DebtRoundUp

LinkedIn: @grayson-bell

“Too many of us are focused on instant gratification, but if you’ve never talked to a lottery winner, then you might not know that it usually ends in failure.“

– Featured quote from Debt Roundup

🏅 Favorite article

While being optimistic about what the future has in store, it’s crucial to be prepared for the worst-case scenario, whatever your current financial circumstances. That is exactly what you can do with How to Easily Recession-Proof Your Finances, learn how you can stay unharmed when the market inevitably goes down hill, so that you don’t have to.Dough Roller

Dough Roller is a blog overflowing with personal finance topics that will help readers manage their money.

Facebook: @Dough Rollers

Twitter: @Doughroller

“For some people (like me) the wealth-building or emotional aspect of owning a home is enough to counterbalance the time it requires. But if you can’t picture yourself settling into domesticity to maintain your new home, maybe you should stick with renting for a while longer.“

– Featured quote from Dough Roller

🏅 Favorite article

Do You Need a Financial Advisor will tell you exactly what a financial advisor does, who they are best able to support and whether you would benefit from paying for one or not.Early Retirement Extreme

Early Retirement Extreme is a personal finance blog targeted to median-income earners who are willing to do what it takes to get financially free and retire early. It’s a blog that shows all things are possible with a large cup of grit and determination.

Facebook: @earlyretirementextreme

Twitter: @extremejacob

“The key to success is to run your personal finances much like a business, thinking about assets and inventory and focusing on efficiency and value for money. Not just any business but a business that’s flexible, agile, and adaptable.”

– Featured quote from Early Retirement Extreme

🏅 Favorite article

How I Became Financially Independent in 5 Years outlines Jacobs journey in becoming financially independent, even before he knew that was his mission.Ellevest

Ellevest is much more than a blog. It is a Robo-advisor run by women to help women who want more money management. Although their magazine offers free and informative articles for the modern woman and money, there is a membership cost.

Facebook: @ellevesting

Twitter: @ellevesting

Instagram: @ellevest

LinkedIn: @ellevest

“Every dollar you invest has to go somewhere, which means it has an impact. And that impact may be aligned with your values. Or it may not be.”

– Featured quote from Ellevest

🏅 Favorite article

In The Financial Wellness Survey: What You Said, Ellevest shares the results of the survey they conducted on over 2,000 women during the COVID-19 pandemic. The results include how the women surveyed felt about money, their perceived career stability and thoughts on saving and investing during the pandemic.Eric Nisall

From personal finance to building a small business, Eric Nisall’s blog will help you understand the jargon, answer the questions you don’t even know to ask about this whole personal finance thing.

Facebook: @EricNisall

Twitter: @ericnisall

Instagram: @ericnisall

LinkedIn: @ericnisall

“Starting a business and being profitable are very different things.”

– Featured quote from Eric Nisall

🏅 Favorite article

In How To Pay Yourself When Self-Employed Eric explains how you should properly pay yourself when you’re self-employed (spoiler, your business is not a personal piggy bank) and why it is vital to keep your business and personal finances separate.ESI Money

ESI Money breaks down money management and growing your wealth into appliable steps. They believe anyone can become financially independent if they’re willing to put in the work.

Facebook: @ESIMoneyBlog

Twitter: @ESIMoneyBlog

Instagram: @esimoneyblog

“The vast majority of people do not have the discipline to keep debt and use it to fund investments. Instead of “investing the difference” by keeping debt most will “spend the difference”. I’ve seen it over and over again.”

– Featured quote from ESI Money

🏅 Favorite article

ESI Money explains how saving is as important as earning in The 52 Best Ways To Make Money. Although not flashy or glamorous they recommend a blend of moderate and selective frugality as the balance between saving and spending.Everything Finance

As the name suggests Everything Finance covers topics from budgeting to goal setting, taxes, money mindset, and everything in between.

Facebook: @EverythingFinance

Twitter: @AllFinance

“The average American is not saving enough for retirement, and this can easily lead to financial stress and even a scarcity mindset.”

– Featured quote from Everything Finance

🏅 Favorite article

6 Best Robo-Advisors to Begin Investing Online With explains how the initial online investing journey can be made simpler with Robo-advisers and that with the help of the modern technology available today, there is no need to feel daunted.Farnoosh

Farnoosh is one of America’s leading finance experts, helping people to live their richest and most fulfilling lives through her personal finance podcast and blog discussing subjects such as debt, saving, and self-employment.

Facebook: @FarnooshTorabi

Twitter: @Farnoosh

Instagram: @farnooshtorabi

“As I developed this whole new way of talking about money and relating to people around their finances, my career matured. The types of issues I tackled matured. I matured.”

– Featured quote from Farnoosh

🏅 Favorite article

With more of us than ever before working at home right now, it’s easy for costs to add up. Farnoosh shares her top tips for avoiding this in Home 24/7? Simple Steps to Avoid Cost Creep and Save Money.Femme Frugality

Femme frugality is a personal finance blog and commentary of current events in the financial world through a feminist lens, covering family finance, saving, and much more.

Facebook: @Femme-Frugality

Twitter: @femmefrugality

Instagram: @femmefrugality

“Saving vs spending is a huge battle that each one of us fights. We may fight it on the daily if we’re shopaholics, or we may fight it only during periods of emotions distress.”

– Featured quote from Femme Frugality

🏅 Favorite article

Learn how neuroscience affects financial decision making in What Neuroscience Says About Making Financial Decisions and how you can get support if this is something you struggle with.

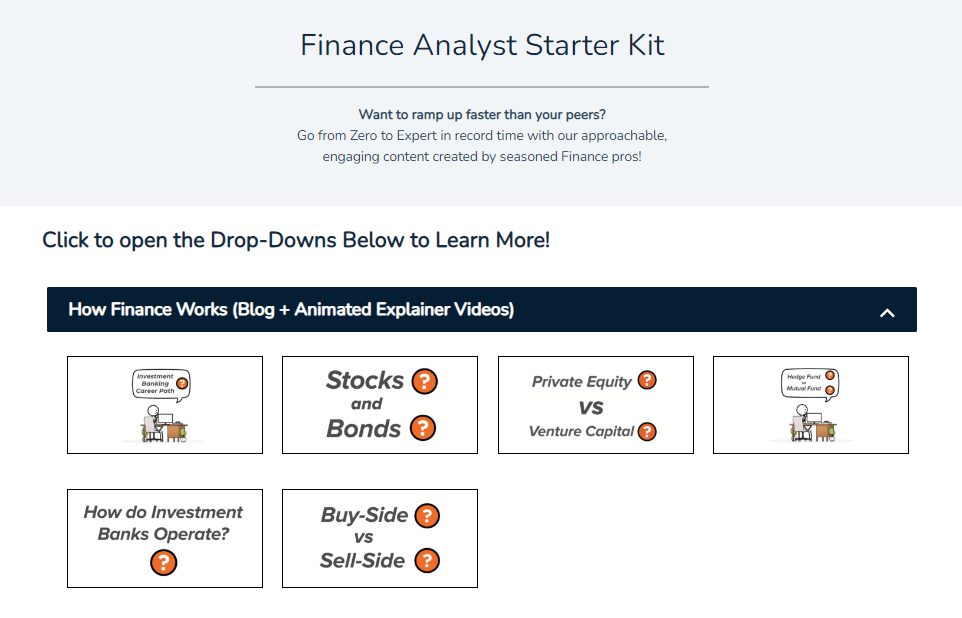

Finance Analyst Starter Kit

Finance Analyst Starter Kit from Finance|ables offers tons of resources for those wanting to learn more about finance. The platform was created to allow readers to go from zero to expert in record time, with engaging content. Learn everything from how finance works, to understanding complex finance terms.

Facebook: @Financeable1

Twitter: @Financeable1ter.com

LinkedIn: @Finance-Able

“Finance|able was created to fill the void in the market for approachable, intuitive finance career training.”

– Featured quote from Finance|able

🏅 Favorite article

Learn Finance ASAP #2: Intrinsic Business Valuation is the second part of the Learn Finance ASAP series and digs into the concept of intrinsic valuation and how it applies to businesses.Financial Residency

Financial Residency is a blog and podcast jam-packed with the kind of free and actionable financial education that you didn’t learn in college. The blog is targeted toward doctors but has value to other professionals looking for ways to grow their wealth.

Facebook: @physicianfinance

Twitter: @physicianwealth

Instagram: @financialresidency

“To establish a strategy to pay down debt, you have to look at it line by line. You may think you know the exact amounts or you’ve been afraid to look at your statements in detail. Either way, take time to get the exact numbers on paper.”

– Featured quote from Financial Residency

🏅 Favorite article

Choosing a Financial Advisor: The Definitive Guide is a great place to start for anyone, but especially physicians, who don’t know where to start when finding someone to help them grow and protect their assets.Financial Samurai

The Financial Samurai is a one-stop shop for all things FIRE. The blog is written by Sam, who delves into the realm of investment, real estate, planning for retirement, and personal development strategies that help you build passive income.

Facebook: @financialsamurai

Twitter: @financialsamurai

LinkedIn: @financial-samurai

“Know that there is money everywhere for the taking. You’ve got to believe you deserve to be rich.“

– Featured quote from Financial Samurai

🏅 Favorite article

The First Million Might Be The Easiest: How To Become A Millionaire By Age 30 shares the experience of a 40 year-old millionaire who made his first million in his twenties and the advantages he believes youth gave him.Four Pillar Freedom

Four Pillar Freedom helps readers build wealth, invest and gain financial freedom so that like him, they can live a rich life. His unique framework is made up of the following four pillars; philosophy – identify your “why”, psychology – reduce spending, work ethic – increase income, and finance – grow wealth.

Twitter: @4PillarFreedom

“The first step to generating wealth is to acquire knowledge in some niche topic that most people find difficult to learn.”

– Featured quote from Four Pillar Freedom

🏅 Favorite article

The Opposite of the Latte Factor flips the usual idea of investing a small daily expense such as the cost of a latte instead of spending it on it’s head. Rather than saving that small daily amount that adds up over time but potentially decreases your happiness, increase your daily earning a small amount each day and watch both your finances and happiness grow.Want To Save More?

Find Financer.com’s top saving tips here.Frugal Beautiful Life

Frugal Beautiful Life offers creative ideas on how to get really smart with every dollar you spend. Shannyn says she’s committed to living a debt-free life, so if you feel the same then this could be the blog to help you get there.

Facebook: @frugalbeautiful

Twitter: @howdyshannyn

Instagram: @howdyshannyn

“Frugality is a way of life so you can spend wisely. Spend fabulously on what matters to you, and skip or save on the rest.”

– Featured quote from Frugal Beautiful Life

🏅 Favorite article

The Mason Jar Money Method is a fun, simple, and easy way to save some extra cash throughout the year that anybody can get started with today.Frugalwoods

Nate and Liz are the Frugalwoods and inspire others to manage their money to create new opportunities that wouldn’t exist without financial independence. Their blog covers a wide range of topics from conscious living, minimalism, and real estate to travel, home improvements, and marriage.

Facebook: @frugalwoods

Twitter: @FrugalWoods

Instagram: @frugalwoods

“Too often, money is discussed in hushed tones, behind closed doors, underneath covers, or, more likely, not talked about at all. A lot of us (me included) feel stupid if we don’t know what a financial term means and we aren’t sure if it’s ok to ask questions.“

– Featured quote from Frugalwoods

🏅 Favorite article

Frugality is a Compounding Game speaks to the power of the compound effect and reminds us that we’re capable of doing a lot more for ourselves than we sometimes believe.Get Rich Slowly

J.D. Roth from Get Rich Slowly has been helping people master their finances and find early retirement since 2006.

Facebook: @getrichslowlyorg

Twitter: @getrichslowly

Instagram: @jdroth

LinkedIn: @getrichslowly

“Smart money management is more about mindset than it is about math. The math of personal finance is easy. It’s the psychology that’s tough.”

– Featured quote from Get Rich Slowly

🏅 Favorite article

Becoming aware and intentional with your habits is a crucial part of your financial journey and The Power of Habit Tracking describes exactly why that is.Girls Just Wanna Have Funds

This one is for the ladies. Girls Just Wanna Have Funds is a well-rounded, holistic approach to personal finance. Inspired by seeing her own mother hold down the fort after her father passed away, Ginger has been using Girls Just Wanna Have Funds to help other women succeed financially whatever life throws at them since 2003.

Twitter: @gingerrlatte

Instagram: @gingerrlatte

“Realize that if you don’t take control of your finances, then it will take control of you.“

– Featured quote from Girls Just Wanna Have Funds

🏅 Favorite article

In These Top Tips will Help you to Avoid Bad Investments, Ginger shares how you can bypass the bad investments and avoid throwing your money down the drain.Good Financial Cents

Jeff Rose is a familiar name and trusted advisor on all things finance. You may just want to pin Good Financial Cents to your toolbar as once you’ve explored his insightful and easy-to-read articles on everything from money management to taxes, you will probably be a regular reader.

Facebook: @GoodFinancialCents

Twitter: @jjeffrose

LinkedIn: @jeffrosecfp

“Don’t whine because you’re not a millionaire yet. It’s okay to dream, but remember that contentment should be a cornerstone of your financial plan.“

– Featured quote from Good Financial Cents

🏅 Favorite article

What Is Liquid Net Worth tells us exactly why liquid net worth matters, the difference in total net worth and liquid net worth, and how you can calculate it for yourself.Her First 100k

Her First $100k is for the ladies. Saving $100,000 by 25 Tori writes articles that help women gain control over their money and build financial confidence, just like she did.

Facebook: @herfirst100K

Twitter: @herfirst100K

Instagram: @herfirst100k

LinkedIn: @toridunlap

“We won’t have true equality until we have financial equality.”

– Featured quote from Her First $100K

🏅 Favorite article

Everyone had faced uncertainty at some point in their lives, it is an unavoidable part of life. In Your Financial Checklist in Times of Uncertainty, Tori lays out an informative and practical step by step list especially for college students facing difficult times.His and Hers FI

His and Hers FI helps couples master their money and build a life with a plan. The blog’s author, Bethany, is an experienced freelance financial writer and speaks on subjects such as paying off student debt, budgeting for travel and finding success as a freelancer.

Facebook: @hisandherfipost

Twitter: @hisandherfipost

Instagram: @hisandherfipost

LinkedIn: @bethany-mccamish

“Your financial goals should be reflective of what you need in order to build wealth AND what you need in order to stay balanced as a human. “

– Featured quote from His and Hers FI

🏅 Favorite article

When moving, you spend a lot of time thinking about all of the things you want for your new home. In We Said ‘No’ to These 5 Things For Our New Home, Bethany talks us through the opposite process and the ways she has saved money by opting out of expected purchases.I Will Teach You To Be Rich

One of my personal favorites! Ramit Sethi takes a different approach to building a rich life that is inspiring. You won’t find a list of things to cut out of your life here. What you will find are new ways to say yes to more opportunities.

Facebook: @IWT

Twitter: @ramit

Instagram: @ramit

“The uncomfortable truth about growing a business is you will have to get comfortable with selling yourself.”

– Featured quote from I Will Teach You To Be Rich

🏅 Favorite article

The Hedonic Treadmill and How You Can Jump Off teaches us about hedonic adaption and how to stay off the treadmill which can be so exhausting and destructive.🏅 Favorite article

Usually, business is all about making money. As much of it as possible. But in How to Give When You Have a Business, you can learn how to put some of that money to good use and spread the wealth to those who need it.Jean Chatzky

Jean Chatzky’s motto is to make money make sense, and that’s exactly what she does through her books, podcast, and blog. Jean believes that with a little effort anybody can get learn to manage their finances successfully.

Facebook: @JeanChatzky

Twitter: @JeanChatzky

Instagram: @jeanchatzky

“Earning more than you need to live comfortably is nice, but it doesn’t increase your happiness.”

– Featured quote from Jean Chatzky

🏅 Favorite article

In How to De-Stress During Tax Season and Take Control of Your Money, Jean shares her top tips for taking the unnecessary stress and fear out of taxes.JL Collins

JL Collins writes an excellent blog for understanding stocks, money, life, and business. In what he describes as ‘The simple path to wealth’, the author shares his thoughts on investments and money management in humorous and easy-to-read articles.

Twitter: @JLCollinsNH

“Nothing will destroy your wealth faster than letting someone else have access to it. Fiscally irresponsible people have squandered their money and will happily squander yours. “

– Featured quote from JL Collins

Just Start Investing

From investing to budgeting and overcoming debt, the Just Start Investing blog breaks down challenging concepts along the financial freedom journey.

Facebook: @JustStartInvesting

Twitter: @JustStartInvest

“The more income sources you have, the less impacted you will be if one of those income streams dries up. Similar to how when one part of your investment portfolio is struggling, other assets can pick up the slack.“

– Featured quote from Just Start Investing

🏅 Favorite article

Why You Need a Personal Financial Statement explains what is included in a personal financial statement, the different reasons why you may require one and how often you should update it.Not A Reader?

If reading is not your thing, check out Financer.com’s list of best personal finance podcasts here.Learn Hustle Grow

From real estate investing to entrepreneurship, the Learn Hustle Grow blog will inspire you to get out of debt and face the challenge of financial independence head-on. Prefer to watch and learn, instead? Check out the Learn Hustle Grow Youtube channel for lots of inspiring and educational videos.

Facebook: @learnhustlegrow

Twitter: @learnhustlegrow

Instagram: @learnhustlegrow

Youtube: Learn Hustle Grow

“The difference between you and everyone else is your mindset.”

– Featured quote from Lean Hustle Grow

🏅 Favorite article

Reshawn shares how you can manage your money successfully in a relationship in Managing Money As A Couple. From agreeing on your plans and getting on the same page to executing income strategies together – this article is for anyone looking to grow their wealth as a partnership.Learn to Trade the Market

Learn to Trade the Market is teeming with great content written by Nial Fuller, a recognizable name in trade coaching. If you are new to trading and want to know more about trading journaling, strategies and tracking, this is a great place to start! If you are experienced, you’re probably already reading it.

Facebook: @learntotradethemarket

Twitter: @NialFuller

Instagram: @nialfuller

LinkedIn: @nialfuller

“One of the hardest truths about trading to implement is that if you hope to become consistently profitable you’re going to have to think and act like you are BEFORE you are.”

– Featured quote from Learn to Trade the Market

🏅 Favorite article

This is How Millionaire Traders Think & Act teaches aspiring traders how to act like the millionaire trader they one day hope to become. By exploring what they value and how they act you can follow in their footsteps.Living Low Key

Cassie and David have become debt-free and invite readers on a journey to join them as they reach new heights of financial freedom by Living Low Key.

Facebook: @livinglowkey

Twitter: @living_low_key

Instagram: @living.low.key

“In order to save a large amount of money, you have to come up with ways to make saving fun! If we wouldn’t have found ways to make saving fun, we never would have met our goal.”

– Featured quote from Living Low Key

🏅 Favorite article

50 Genius Frugal Living Tips has more than enough ideas to help you along your own money-saving journey.The Mad Fientist

The Mad Fientist is a blogger and podcaster passionate about helping people on their financial independence journies. With a specific focus on innovative tax-avoidance methods, this blog is ideal for anyone looking to retire very early in life.

Facebook: @madfientist

Twitter: @madfientist

“When you reach the finish line but don’t experience the happiness you were expecting, you tend to just move the goalposts or create a new goal, thus further delaying your happiness even more.”

– Featured quote from The Mad Fientist

🏅 Favorite article

In The Best and Worst Thing About Saving Money, The Mad Fientist shares his own experience since becoming financially independent, his struggle with creating a growth mindset and the potential hazard of post-FI life as well as the many positives.Making Sense of Cents

Focused on personal finance and lifestyle, Making Sense of Cents helps those who want to make more, save more, and live financially free. As an experienced financial analyst turn solopreneur, Michelle has been sharing her wisdom since 2011.

Facebook: @MakingSenseofCents1

Twitter: @SenseofCents

Instagram: @michelleschro

“The sooner you start saving, the more it becomes a habit and the easier it will become. By saving money in your 20s, you will learn good financial habits that will help you well into the future.”

– Featured quote from Making Sense of Cents

🏅 Favorite article

In Mistakes I Made When I Bought My First House At The Age of 20, Michelle shares her personal experience of being a young homeowner and the things she would do differently with the hindsight and experience she has now.Marriage Kids and Money

Marriage Kids and Money is an inspiring blog that helps build a life of freedom, legacy, and financial peace for your family. If you’re a parent then this is the personal finance blog for you.

Facebook: @andyhillMKM

Twitter: @AndyHillMKM

Instagram: @andyhillmkm

“The less debt you have, the more money you are able to save on a monthly basis towards your goals.”

– Featured quote from Marriage Kids and Money

🏅 Favorite article

If you have children you probably want to help them as much as possible in life, but with so many different things to save for and investment options out there, it’s hard to know where to start. Learn what you need to get in place before you even begin investing for your child and the best ways to help them in What is The Best Way to Invest For My Child’s Future?Mastering The Side Jam

Robin Rose is a self-proclaimed reformed spender. Robin invites you on a journey through her blogs of becoming herself, building a side income, and making extra cash.

Facebook: @sidejambiz

Twitter: @sidejambiz

Instagram: @sidejambiz

“Asking for a raise during a pandemic may seem like a bad idea — But if you’ve been able to succeed at your job while under the stress of quarantine, it’s likely well deserved.”

– Featured quote from Mastering The Side Jam

🏅 Favorite article

There are so many side hustle ideas out there, but some will be more suited to your personality than others. Robin shares her top tips for finding a successful side hustle as an introvert in Side Hustle Ideas for Introverts.Millennial Money Man

Millennial Money Man helps Millennials gain control of their money. Bob Hoyt, the Millennial Money Man, takes a refreshingly honest approach to help millions of people find personal finance strategies that work.

Facebook: @genymoneyman

Twitter: @GenYMoneyMan

Instagram: @genymoneyman

“Freelancing isn’t a buzzword or trend. It’s a legitimate work situation for millions of Americans, and more people are choosing to freelance because of the amount of flexibility it can provide.”

– Featured quote from Millennial Money Man

🏅 Favorite article

Sometimes it’s not finding a second income that’s the issue, it’s knowing what to deal with and how legally to declare it. How to Handle Taxes for Your Side Hustle can help you with that.Millennial Money

Millennial Money helps readers make smart financial decisions, builds strong new businesses, hustle to reach financial independence, and live more fulfilled lives.

Facebook: @MillennialMoneycom

Twitter: @millennialmoney

Instagram: @millennialmoneycom

LinkedIn: @millennial-money

“Money is infinite but time is not. That’s why I passionately advise that money isn’t the goal; time is.”

– Featured quote from Millennial Money

🏅 Favorite article

Learn to level up your investment choices and avoid gambling with Best Investing Strategies.Millennial Revolution

Millennial Revolution is for those wanting to go against the grain and invest instead of spending to build a passive income that will help you move from employee to retiree fast than you think is possible.

Facebook: @MillennialRevolutionBlog

Twitter: @FIRECracker_Rev

“The finance industry is here for one reason and one reason only: to take as much of your money as they can. “

– Featured quote from Millennial Revolution

🏅 Favorite article

Reaching FIRE (financially independent retire early) is a goal that many of us share. But FIRE Doesn’t Fix Everything reminds us of some of the things achieving this goal will not be able to help with.Modern Frugality

Modern Frugality’s author Jen is a personal finance writer and co-host podcaster who shares her and her husband’s success story of paying down their debt in 2 years with smart spending and frugal living.

Facebook: @modernfrugality

Twitter: @modernfrugality

Instagram: @modernfrugality

“Breaking bad habits will save you so much money and it’ll get you to the point where you’re spending with intention instead of letting a well-crafted ad or yummy smell control your wallet.”

– Featured quote from Modern Frugality

🏅 Favorite article

Can You Pay Off A Car Loan Early? How To Know + When It Makes Sense has everything you need to know about paying off your car loan.

Modest Money

New to investing? Modest Money teaches people the importance of smart investing and how to become financially successful.

Facebook: @ModestMoney

Twitter: @ModestMoney

LinkedIn: @modest-money

“The reality is that timing the market almost never works in the investor’s favor. The reason is simple: past performance is not necessarily indicative of future performance.”

– Featured quote from Modest Money

🏅 Favorite article

Net Worth by Age: Are You Saving Enough? is a helpful guide on how much you should be saving and what you need to consider within different age brackets.Money After Graduation

Money After Graduation offers a wide range of educational resources for young professionals who want to build wealth after graduating. They offer targeted courses to help build financial literacy along with quality articles.

Facebook: @MoneyAfterGraduation

Twitter: @moneyaftergrad

Instagram: @moneyaftergrad

“Income is the heart of your financial health. If you take care of this, the rest will (almost) always take care of itself.”

– Featured quote from Money After Graduation

🏅 Favorite article

What I Wish I Knew About Credit Scores Before Age 25 shares Bridget’s experience of getting in control of her finances in her 20’s and the role that becoming familiar with her credit score played in this.Money Geek

Money Geek shares the latest personal finance opportunities. Their comprehensive articles help readers with everything from financial planning to credit cards and loans.

Facebook: @moneygeekcom

Twitter: @money_geek

LinkedIn: @MoneyGeek.com

“It’s never too late to start saving. Whether retirement is far in the distance or on your doorstep, what’s important is to figure out what you’ll need and start working toward that goal. “

– Featured quote from Money Geek

🏅 Favorite article

If buying a house is high on your list of priorities then Mastering the Art of the Down Payment is essential reading.Money Peach

Chris Petrie is a personal finance expert and money coach who helps readers and listeners get out of debt and into financial freedom. After drowning in a mountain of debt himself, Chris now relishes being able to take control of his financial success and encourages others to do the same.

Facebook: @themoneypeach

Twitter: @TheMoneyPeach

LinkedIn: @moneypeach

“The first sinking fund everyone will need is an emergency fund. Studies show that everyone will experience a devastating financial emergency within any 10 year period. It’s not a matter of if, but a matter of when.”

– Featured quote from Money Peach

🏅 Favorite article

Pay Off Your Mortgage Faster with Bi-Weekly Mortgage Payments can be enjoyed either by reading or watching the complimentary video.

Money Saving Mom

Money Saving Mom is an inspiring blog that helps readers become aware and intentional about their money and their lives. If you’re a mother, you’ll find lots of helpful advice here.

Facebook: @MoneySavingMom

Twitter: @MoneySavingMom

Instagram: @allthebestdeals

“Before you jump into making money as a blogger, I strongly encourage you to focus the first few months on producing great content and building your readership. Remember, this is a marathon, not a sprint.”

– Featured quote from Money Saving Mom

🏅 Favorite article

We Paid Cash: an RV shares Crystal’s experience in paying cash for her campervan investment including how she saved for it and even used paying cash to her advantage when negotiating.

Money Smart Life

Ben Edward’s obsession with personal finance began when he was just 12-years old and would ask for stocks for Christmas. Now he dedicates his time to igniting the same passion in others and helping people to live the life they truly want.

Twitter: @MoneySmart

“One of the best ways to stop feeling overwhelmed by investing is to make use of dollar cost averaging. This is a strategy that involves taking smaller amounts of money and consistently investing. “

– Featured quote from Money Smart Life

🏅 Favorite article

Sometimes it’s the little things that add up to make the biggest difference. Stock up on savvy dining tips with 10 Ways to Cut Your Restaurant Bill Big Time.MoneyNing

MoneyNing is a common-sense blog with practical money advice on saving, getting out of debt, and building wealth through small smart decisions.

Facebook: @MoneyNing

Twitter: @MoneyNing

“Tweaking our outlook can dramatically improve our life. There’s no doubt about it. “

– Featured quote from MoneyNing

🏅 Favorite article

3 Ways to Stop Being Your Own Financial Enemy is a reminder to us all to stop getting in our own way and sabotaging the success we know we deserve.Moolanomy

Moolanomy, a simplified guide to financial freedom, this blog is packed with information and resources to help you wherever you are in your financial journey. Their motto is ‘Moolanomy – the science of money.”

Facebook: @moolanomy

Twitter: @moolanomy

Linkedin: @pinyobhulipongsanon

“I believe your choice of a marriage partner will be your single biggest financial decision. “

– Featured quote from Moolanomy

🏅 Favorite article

Treasury Bonds vs Corporate Bonds is there to teach you the main differences between these two types of bonds.Mr. Money Mustache

Mr. Money Mustache is a blog sharing the secrets of how to save hard, cut spending, and retire early. It’s a call to action the desire in you to break free from the chains of consumerism and actually have time to live.

Facebook: @mrmoneymustache

Twitter: @mrmoneymustache

“Your current middle-class life is an Exploding Volcano of Wastefulness, and by learning to see the truth in this statement, you will easily be able to cut your expenses in half – leaving you saving half of your income.“

– Featured quote from Mr. Money Mustache

🏅 Favorite article

We’ve all heard the stories of people retiring in their 20’s, but in The Man Who Retired at 27: Why You Should Consider House-Hacking Mr. Money Mustache shares how you can try house-hacking and achieve an early retirement for yourself.

My Fab Finance

Tonya began My Fab Finance at a time when her finances felt completely out of order. She now takes pride in helping others who want to transform their money stories just like she did.

Facebook: @MyFabFinance

Twitter: @MyFabFinance

Instagram: @myfabfinance

LinkedIn: @tonyarapley

“Money isn’t as hard as we assume it is. Debt, financial stress, and embarrassment don’t have to be a part of your story.”

– Featured quote from My Fab Finance

🏅 Favorite article

As personal finance enthusiasts, we’re always looking for the latest rules and advice to follow. But 3 Money Rules to Ditch This Year takes a look at the rules we can say goodbye to instead.My Financial Shape

My Financial Shape follows a 40-something’s journey on becoming financially independent through investing in cash-generating assets, smart saving, and growing passive income streams.

Twitter: @financialshaper

“You must put yourself in a position – financially and mentally – in which you have options.”

– Featured quote from My Financial Shape

🏅 Favorite article

Tesla’s Much More Than Cars dives into the potential of Tesla as a super growth company with a very rich valuation.My Money Blog

Jonathan Ping has been sharing his views on personal finance since 2004 through My Money Blog. This well-recognized blog covers a vast range of personal finance topics and has something for everyone.

Facebook: @mymoneyblogcom

Twitter: @mymoneyblog

“If you want to achieve early retirement, my rule of thumb is that you should only pay CASH for cars.”

– Featured quote from My Money Blog

🏅 Favorite article

One out of a four part series, Early Retirement Lesson #1: Savings Rate goes into the first of four lessons that Jonathan has learnt through his early retirement journey.Oblivious Investor

The intent behind Oblivious Investor is to prove that investing can be simple. Mike, a former accountant now financer writer, is an expert in breaking down everything finance from taxes to accounting to understanding social security calculations.

Twitter: @michaelrpiper

LinkedIn: @mike-piper-oblivious

“If your portfolio is properly set up, it’s OK to be “oblivious” to much of the financial media and most of the day-to-day happenings in the market.”

– Featured quote from Oblivious Investor

🏅 Favorite article

If you’re not sure where to begin investing Why Invest in Index Funds? will give you a good starting place and some things to consider.Of Dollars And Data

Of Dollars and Data takes a unique personal finance approach by using data analysis to help make great money decisions. What began as a New Years Resolution by Nick Maggiulli in 2017 has turned into a passion for helping others live a smarter, richer life.

Twitter: @dollarsanddata

“If you are really serious about growing your wealth, you should consider everything that the investing world has to offer.”

– Featured quote from Of Dollars and Data

🏅 Favorite article

In Climbing the Wealth Ladder, Nick shares his different levels of wealth and how the jump from each one can vary in how difficult it is to reach and the impact it has on your life.Our Next Life

Our Next Life is authored by Tanja Hester and Mark Bunge who retired early and have built an online community to help support you along your own path to early retirement and financial freedom.

Facebook: @ournextlife

Twitter: @our_nextlife

Instagram: @our_nextlife

“it’s easy to view frugality as all or nothing or to see frugality as trumping other values. but it doesn’t have to.“

– Featured quote from Our Next Life

🏅 Favorite article

While your financial health is sure to be high up on your list of priorities, there are other values you need to balance this with in order to stay true to yourself. Explore this and more in Our Triple Bottom Line // Balancing Frugality With Our Values.Penny Pinchin Mom

Tracie helped her family get out of debt and now helps readers do the same. Her savvy blog Penny Pinchen Mom is full of money-saving tips, coupons, and deals.

Facebook: @PennyPinchinMom

Twitter: @PennyPinchinMom

Instagram: @pennypinchinmom

“If you don’t have a budget, you have no idea where you need to spend your money. You never understand where every single dollar goes. Without a budget you have no control.”

– Featured quote from Penny Pinchin Mon

🏅 Favorite article

Everything You Need to Know to Start Using Coupons is the ultimate starter guide for anybody new to couponing.

Retire By 40

Jo Udo started the Retire By 40 blog to follow his own early retirement journey. Since then, the blog has grown and offers a range of finance articles to help readers work towards their own early retirement goals.

Facebook: @RetireBy40

Twitter: @retirebyforty

Instagram: @retirebyforty

“Being lucky is really keeping your eyes open for opportunities.“

– Featured quote from Retire By 40

🏅 Favorite article

Facing Adversity In Early Retirement is a raw early retirement update sharing what happens when things don’t go exactly how you hoped.

Rich and Regular

Rich and Regular is a blog and community created to help people have better conversations about money. Kiersten and Julien provide resources in all things money, relationships, and financial independence.

Facebook: @richandregular

Twitter: @richandregular

Instagram: @richandregular

LinkedIn: @richandregular

“I’m finally at a point in my life where I can choose me. My job was creating friction because the traditional workplace isn’t set up to support employees who make that kind of choice.”

– Featured quote from Rich and Regular

🏅 Favorite article

Have you outgrown your financial hero? shows the interesting perspective of outgrowing people we previously idolised and becoming your own hero.

🏅 Favorite article

Zero to Millionaire In Ten Years takes us through an inspiring true story of how a regular couple completely transformed their finances over the course of a decade, ending in a very early retirement.Saving Advice

A personal finance blog, Saving Advice is dedicated to inspiring readers to save their hard-earned money and they have created a community of savers who enjoy healthy discussions on all kinds of finance-related topics and news.

Facebook: @savingadvice

Twitter: @savingadvice

“Believe it or not, financial responsibility is a major part of a military career and as an officer or enlisted member you can get into a lot of trouble if you don’t handle your finances properly.”

– Featured quote from Saving Advice

🏅 Favorite article

The investment climate is constantly evolving and affected by all kinds of things, as shown in The Impact of Social Media on Investing.Seed Time

Seed Time aligns faith with finance and helps readers understand the biblical value of money. Bob Lotich shows you how to use money as a tool to change lives.

Facebook: @seedtimeblog

Twitter: @seedtime

Instagram: @seedtime

“Anyone who has really felt the effects of their debt can understand why the Bible says that the “borrower is slave to the lender”. The weight of that burden can have terrible consequences.”

– Featured quote from Seed Time

🏅 Favorite article

Habits Of The Truly Successful With Mark Batterson is an inspiring read filled with lots of practical advice for how you can change up your habits and become more successful.

Smart Money Mamas

Smart Money Mamas is a blog and podcast run by Chelsea, an ex-hedge fund investor who now helps moms with investing, money management, and living their best life.

Facebook: @smartmoneymamas

Twitter: @SmartMoneyMamas

Instagram: @smartmoneymamas

“Your budget doesn’t have to be a restrictive part of your life that you’re always fighting against. Instead, your budget should be an empowering, fun part of your money plan that helps to align your spending with what matters most to you. “

– Featured quote from Smart Money Mamas

🏅 Favorite article

How to Help Your Child Become a Business Savvy CEO Kid is a fun read about raising strong and savvy, entrepreneurial children including a course that helps you to help them.

Something Finance

Something Finance is an edgy blog about financial independence for the younger readers who want to gain control over their spending habits and build their financial future.

“Imagine what it would be like to pay off all your debts, retire at 40, afford your dream home or have the financial freedom to travel around the world. It is absolutely not as hard as you may think it is.”

– Featured quote from Something Finance

🏅 Favorite article

How to Save Money; 20 Crazy Simple Ways to Save $300 Every Month is full of great money-saving tips which can add up to big savings over time.Squawkfox

Squawkfox has helped readers make better financial decisions for well over a decade. Kerry Taylor’s unique skillset helps people understand human behavior, emotions, and how they affect money.

Facebook: @squawkfox

Twitter: @squawkfox

Instagram: @squawkfox

“Debt is not your friend, and you should not be friendly with your debt. “

– Featured quote from Squawkfox

🏅 Favorite article

Start your debt-reducing action plan today with the Getting out of debt with the Debt Reduction Spreadsheet 2023.Stefanie O’Connell

Stefanie O’Connell is an author, journalist, and blog writer who covers the different ways that ambition touches women’s lives, including money, power, and careers.

Twitter: @stefanieoconnel

Instagram: @stefanieoconnell

“At this point, I feel like the best piece of advice I could give to ambitious women is to ignore most advice for ambitious women.”

– Featured quote from Stefanie O’Connell

🏅 Favorite article

Stop Telling Women To is a powerful piece showing the many things women are told again and again, whether it’s helpful or not.The College Investor

The College Investor is a blog dedicated to helping people escape student loan debt and build long-term wealth. There’s a huge selection of business and side hustle ideas as well as advice for getting out of debt and becoming financially secure after college.

Facebook: @thecollegeinvestor

Twitter: @CollegeInvestin

Instagram: @thecollegeinvestor

“Speaking from personal experience, adding passive income streams to your portfolio can help you increase your earnings and accelerate your financial goals in tremendous ways. “

– Featured quote from The College Investor

🏅 Favorite article

10 Crazy Ways To Make $10,000 You’ve Never Heard Of shares some of the more unique money-making opportunities out there that can earn you big rewards if you’re up for trying something a little more drastic than online surveys.The Financial Diet

The Financial Diet is a no-judgment, not-so-scary personal finance blog, great for those who want to learn about finance with a more balanced and mental-health friendly perspective.

Facebook: @thefinancialdiet

Twitter: @TFDiet

Instagram: @thefinancialdiet

“As soon as I started the practice of zero-based budgeting, I finally had the lightbulb moment I had been waiting so long to find.”

– Featured quote from The Financial Diet

🏅 Favorite article

6 Benefits Of Ditching A ‘Milestone Mentality’ Once And For All might go against a lot of what you read on other finance blogs, but there’s a lot of sense behind avoiding the potentially damaging mentality of chasing milestone after milestone.The FIoneers

The FIoneers is for those who long to live a different life from the normal western 9-5 and are willing to put the work in to get there.

Twitter: @TheFioneers

Instagram: @thefioneers

“As we gamify financial independence, we also use it to motivate ourselves. We celebrate milestones along the way to stay engaged in building wealth.”

– Featured quote from The FIoneers

🏅 Favorite article

If you’re dreaming of early retirement and potentially getting close, it might be a good time to do a test run. Take a Sabbatical to Test Your Future Plans and many more fascinating articles can help prepare you for the journey. We love how The FIoneers feature stories of people who are designing their lives along the path to FI (not waiting until after).The Military Wallet

The Military Wallet is a beneficial personal finance resource for those specifically in the military. They cover particular money topics and opportunities offered to those serving our country.

Facebook: @TheMilitaryWallet

Twitter: @militarywallet

“It’s easy to say some people just make a lot of money, so they can retire early. But there is a lot more to it than just earning money.”

– Featured quote from The Military Wallet

🏅 Favorite article

How Much Money Do You Need To Start Investing is a great reminder of how much more accessible investing is for those with a limited budget or financial knowledge than ever before.The Minimalists

The Minimalists Joshua and Ryan help people live meaningful lives outside of all the “stuff”, letting go of consumerism and finding what matters in life. Through films, books a podcast and their blog they have helped over 20 million people live a life with more purpose.

Facebook: @theminimalists

Twitter: @TheMinimalists

Instagram: @theminimalists

“So travel the path toward success if you want. Simply know that path diverges from peace. Peace is found only in the present, through awareness and letting go.”

– Featured quote from The Minimalists

🏅 Favorite article

The UnAmerican Dream is a thought-provoking piece on the sacrifices many give up to achieve what we are told success looks like.The Money Habit

If early retirement is on your mind, then The Money Habit can help encourage you to build incremental good financial decisions that will enable you to retire early and comfortably.

Facebook: @themoneyhabit

“When you have a heavy weight to lift, most people understand that it’s better to use a tool to multiply the outcome of your effort. That’s leverage. So when you go out in the world to try and generate money, where is your leverage?”

– Featured quote from The Money Habit

🏅 Favorite article

Most of us have tried some kind of budget before, but have you ever tried a reverse budget? If not then you need to check out The Reverse Budget: Why Normal Budgeting Sucks And What To Do Instead.The Penny Hoarder

One of the country’s largest personal finance sites, the Penny Hoarder blog helps people make smart money decisions by providing articles and resources that build financial literacy.

Facebook: @thepennyhoarder

Twitter: @thepennyhoarder

Instagram: @thepennyhoarder

“If you’re new to budgeting, don’t be discouraged by a few — or many — wrong turns and closed roads along the way. The longer you stick with it, the better you get.“

– Featured quote from The Penny Hoarder

🏅 Favorite article

Owning a car can be a costly expense but in Got a Car? Turn It Into a Moneymaker With These Flexible Side Gigs you can find out how to be making your car earn you money instead.The Savvy Couple

The Savvy Couple, also known as Kelan and Brittany, helps people build budgets and organize their finances. They share openly about their frugal living journey and the need for a side hustle.

Facebook: @thesavvycouple

Twitter: @TheSavvyCouple

Instagram: @thesavvycouple

“Frugal living is not something that happens overnight. It’s a lifelong journey guided by our habits and decisions when it comes to money. “

– Featured quote from The Savvy Couple

🏅 Favorite article

Kelan and Brittany have created the ultimate list of jobs you can do from home and how you can get one for yourself in 35+ Legit Online Jobs to Make Easy Money in 2023. From testing websites to proofreading, they show there really is an online job for anybody out there.The Simple Dollar

The Simple Dollar offers expert financial advice from a large team of professionals helping you make the right decisions when it comes to saving, spending, and investing.

Facebook: @TheSimpleDollar

Twitter: @TheSimpleDollar

Youtube: The Simple Dollar

“No matter where you are on your financial journey, you need to know that it’s possible for anyone to turn their financial life around and start saving money.”

– Featured quote from The Simple Dollar

🏅 Favorite article

If you’re at the beginning of your investment journey then What Does it Mean to Buy a Stock is a great place to start. Learn what stocks are aswell as why and how you can buy them.The White Coat Investor

The White Coat Investor is a finance blog targeted to doctors and other busy high-income earners who desire to convert that income into high wealth over time.

Facebook: @thewhitecoatinvestor

Twitter: @WCInvestor

“Many financial columnists and advisors like to talk about good debt and bad debt. While I’ll readily admit that some debt is far worse than other debt, I don’t really buy into the idea of good debt.”

– Featured quote from The White Coat Investor

🏅 Favorite article

As a parent, there’s no doubt that your children are your world and showering them with gifts and support is might even be one of the reasons you became interested in personal finance in the first place. But some gifts can cause more harm than good, as the Worst Financial Gift to Give Your Children reveals.Think Save Retire

If you need to change the way you think about money, then Think Save Retire is for you. This goal-focused blog will help you define what financial success looks like for you personally.

Facebook: @thinksaveretire

Twitter: @ThinkSaveRetire

Instagram: @thinksaveretire

“You don’t need money to be creative. In fact, lacking resources can be one of the greatest motivators for thinking outside the box and forcing you to use your imagination.”

– Featured quote from Think Save Retire

🏅 Favorite article

If you’re an extrovert, you might find yourself getting into financial difficulty by trying to keep up with a social calendar beyond your means. If that sounds familiar, the Ultimate Extroverts Guide to Avoiding Lifestyle Creep was made for you.Three Thrifty Guys

A great blog written by Three Thrifty Guys. They share their life experiences, finance tips, and offer honest reviews on, well, almost everything!

Facebook: @ThreeThriftyGuys

Twitter: @3thriftyguys

“One thing I’ve learned over all the years is that much of the financial advice out there is surface-level. It often doesn’t get to the root of or deal with the causes many people to struggle or can’t get their financial life together.”

– Featured quote from Three Thrifty Guys

🏅 Favorite article

How Netflix Has Changed American’s Finances is an interesting read about how the popular subscription model can foster poor financial habits and change the way Americans think about spending money.Wall Street Bets

Hosted on Reddit, Wall Street Bets is an investing community created in 2012 to discuss all things related to the stock market. They describe themselves as “apes” but in fact, you may find great value in (some of) their posts. Proceed with caution.

Twitter: @Official_WSB

“I like the stock”

– Wall Street Bets

🏅 Favorite article

Keith Gill’s glorious return after the Congress hearing on Gamestop’s stock alleged price manipulation. Keith doubled down on the GME stock after it suffered major losses, and become once more the hero of the WSB community when they needed him the most.Wallet Hacks

If early retirement is on your mind, then Wallet Hacks will help you make incremental good financial decisions that will enable you to retire early.

Facebook: @wallethacks

Twitter: @WalletHacks

“I think we all choose how to spend our 24 hours each day and some people are better at it because they’ve figured out the game. I’ve figured some of it out and I want to share some of it with you.”

– Featured quote from Best Wallet Hacks

🏅 Favorite article

When you start investing in different areas things can get confusing pretty quickly. 6 Best Free Investment Portfolio Management Software in 2023 will tell you everything you need to know about getting organized and staying on track with your investments.Wealthy Nickel

Wealthy Nickel is an informative blog determined to help readers pay down debt and reject consumerism. Andrews’s goal is to help you along your journey of building financial freedom through his experience.

Facebook: @wealthynickel

Twitter: @wealthynickel

“While comparing your personal finances to the average (or median) American can be useful to know where you stack up, aiming for average is never where you want to be. “

– Featured quote from Wealthy Nickel

🏅 Favorite article

Once you have gotten on top of your own personal finances, you might be ready to teach your kids to do the same. The Best Free Debit Cards for Kids to Teach Them About Money explains what you need in a child-friendly debit card, how they can help you teach them about finance and the best options out there.Well Kept Wallet

Well Kept Wallet is the blog that helps you manage your money, increase savings, pay off debt, and answer all your burning questions with sincere and readable blog posts.

Facebook: @WellKeptWallet

Twitter: @WellKeptWallet

Instagram: @wellkeptwallet

“I’m a big believer that good money management has quite a bit to do with mindset. If you can train your mind to think of money differently, you can learn to handle money better.”

– Featured quote from Well Kept Wallet

🏅 Favorite article

Just because you are aware of how positive investing is for your finances, it’s not always so easy to get started when you don’t have a lot of money to spend. In 13 Simple Ways to Invest With Small Amounts of Money, you can see that investing is for everyone and every budget.Wife.org

Wife stands for Women’s Institute for Financial Education and is the oldest non-profit organization dedicated to providing financial education to women in their quest for financial independence.

Facebook: @WIFE.ORG

“Habits start out like cobwebs but end up as strong as steel cables.”

– Featured quote from Wife.org

🏅 Favorite article

Change Your Habits, Change Your Life shares next habits we can all work on which could drastically affect not just our finances but our whole lives.Women Who Money

Women Who Money is full of money-related articles that will educate you, motivate you, and not only help you climb but conquer the personal money management mountain.

Facebook: @MoneyTalkForWomen

Twitter: @WomenWhoMoney

Instagram: @womenwhomoney

“Getting ahead financially isn’t merely about earning more. It’s also about what you do with that money once you receive it.”

– Featured quote from Women Who Money

🏅 Favorite article

Learn the difference between revenue streams In Active vs Passive Portfolio Income as well as the pros and cons of both.Young Money Blog

The Young Money Blog and the site’s other resources empower young people by providing useful financial information to help them gain control over their financial future.

Twitter: @ionayoungmoney

LinkedIn: @iona-bain

“As a financial blogger and writer, I’ve learned a thing or two about managing money over the years. It’s mainly about setting priorities, being organised, exercising your rights and having a few insiders’ tricks up your sleeve.”

– Featured quote from Young Money Blog

🏅 Favorite article

If you’ve noticed more deliveries than usual appearing at your door recently, then you might benefit from reading Help! I Can’t Stop Buying Stuff Online to learn some tips and tricks to keep your overspending at bay.Your Money Geek

Your Money Geek is a casual financial blog covering money and wealth topics as well as gaming updates and the latest pop culture news. If you’re a self-proclaimed money geek, then this is where your tribe is hiding.

Facebook: @yourmoneygeek

Twitter: @yourmoneygeek

“One thing is sure, the more time one has to save, the easier it will be to retire.”

– Featured quote from Your Money Geek

🏅 Favorite article