Chainlink Price Data

The live Chainlink price today is $14.5300 with a 24-hour trading volume of $372,345,661.

We update our LINK to USD price in real-time. The price of Chainlink has changed -0.57% in the last 24 hours.

Currently, Chainlink is the #18 largest cryptocurrency by market cap, with a live market cap of $8,535,125,962.00. It has a circulating supply of 587,099,971 LINK coins and a maximum supply of 1,000,000,000 coins.

See where to buy Chainlink or use our Chainlink Profit Calculator to calculate and track the performance of your investment.

A beginner’s guide to Chainlink

What is Chainlink?

Chainlink is a decentralized oracle network that enables secure communication between crypto blockchains and the outside world.

Chainlink was the first crypto project to introduce a secure and decentralized way to send information outside a blockchain to a blockchain.

This allows external companies and systems to join the blockchain and safely benefit from the decentralized platform.

- The platform uses smart contracts to carry out transactions.

- Through the Chainlink platform, a person can connect with other blockchains.

- LINK is the network’s native cryptocurrency used to facilitate contracts.

What determines the price of Chainlink (LINK)?

Like other cryptocurrencies, the price of the Chainlink coin is determined by the supply and demand forces in the crypto market. If the demand for the token increases, the price will also increase, as more people buy LINK.

The opposite is also true. As more people sell LINK, the selling activity will create downward pressure on the price of LINK.

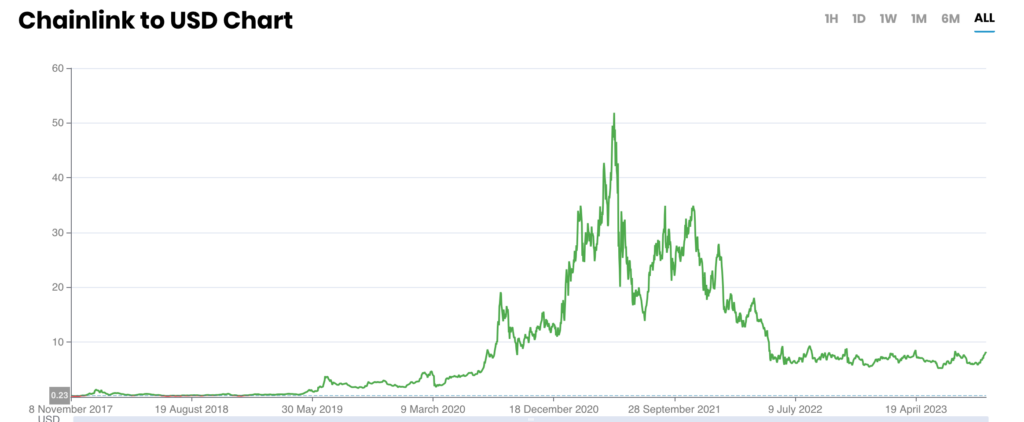

Chainlink price history

From its early days in 2017 through 2018, LINK remained a relatively obscure token. LINK started to pick up in 2019 experiencing significant gains, going from a few cents a couple of years before to nearly $20 by 2020.

The following year, LINK more than doubled its value, trading for as high as $52 before succumbing to the market-wide crash that saw most cryptocurrencies lose a significant chunk of their value.

Since the market peak of 2021, LINK has lost more than 80% of its value.

How Chainlink works

As mentioned earlier, Chainlink is an Oracle network of service providers and customers.

The two parties communicate over the network using smart contracts. The smart contract is a sort of agreement where customers request data and pay for the service with a LINK token.

Chainlink first focused on Ethereum smart contracts but has since extended support to other blockchains. Other blockchains supported by Chainlink include the BNB chain, Polygon, Avalanche, Fantom, Arbitrium, and Optimism.

What is Chainlink used for?

The Chainlink network is used by people who want to sell or buy data. Any company or person can host a node on the platform, so it is open to anyone.

To understand how chainlink works, you first need to know what blockchain oracles are:

An oracle is a third-party service that provides information to a blockchain. This information can be anything, for example, the price of a product or even the temperature outside. Oracles are important because they help smart contracts access information outside a blockchain – information it might need to trigger a clause.

Chainlink is made up of such Oracle nodes that connect smart contracts created on the platform to external parties.

The Chainlink network consists of these oracles, which help the platform serve as a decentralized medium for secure information exchange with external networks.

Who are the founders of Chainlink?

Chainlink was founded in 2017 by Sergey Nazarov and Steve Ellis.

Sergey has previous experience in the crypto world, having founded the Secure Asset Exchange crypto exchange. Steve also worked with Sergey on this project.

In the years since its founding, Chainlink has undergone a series of upgrades:

- In 2018, the Town Crier blockchain was integrated into the project, allowing the Ethereum blockchain to be connected to HTTPS-based web resources.

- In 2019, the smart contracts network was launched.

- In 2020, Chainlink was further expanded with a project at Cornett University: the integration of the DECO protocol further helped validate sensitive data on the blockchain.

- The second white paper of the project was published in 2021.

What makes Chainlink unique?

The uniqueness of Chainlink comes from its off-chain architecture. Chainlink was the first decentralized network that allowed information outside the blockchain to be accessed inside the blockchain.

The value of Chainlink lies in its ability to connect off-chain data sources to on-chain contracts. From the start, the project has sought to minimize Oracle errors.

Chainlink is still the largest and most advanced Oracle network in the industry by market capitalization, making it a leader in this respect.

How is Chainlink secured?

The Chainlink network is a Proof of Stake (PoS) system, which means that validators are responsible for the secure processing of transactions with their own staked coins.

If the transaction has been completed correctly, validators will receive additional coins depending on the amount staked.

- This reward system prevents validators from behaving maliciously.

- If a validator does not work properly, they will lose the amount of cryptocurrency they have staked, as well as their reward.

A similar Proof of Stake system is used by major cryptocurrencies, such as Ethereum, BNB, Cardano, or Polkadot.